Introduction: Why Paris Fashion Week Remains Fashion’s Grand Finale

Following New York, London, and Milan, Paris Fashion Week (September 29–October 7, 2025) serves as the spectacular conclusion to fashion month. As the longest and most prestigious of the four major fashion weeks, Paris holds a unique position in the industry. It’s not just about the volume of shows—it’s about the caliber. Paris is home to the most influential haute couture houses, including legendary names like Giambattista Valli, Givenchy, Jean Paul Gaultier, Maison Margiela, Christian Dior, and Chanel.

This autumn’s Paris Fashion Week (#PFW) showcased the SS26 (Spring/Summer 2026) collections and highlighted a remarkable phenomenon: Thai celebrities at Paris Fashion Week 2025 and, more broadly, the growing influence of Asian markets, particularly Thai celebrities, alongside K-pop superstars, who have become indispensable in luxury brand strategies. The figures convincingly illustrate the convergence between traditional luxury fashion and global digital culture. Here is Onclusive‘s analysis of the media impact of PFW.

Table of Contents

Key Takeaways

I. The Numbers: PFW’s Unprecedented Media Dominance

II. Brand Analysis: The Hierarchy of Fashion Power

III. Why Christian Dior Tops Mentions in Social Media and Digital News

IV. The L’Oréal Paris Phenomenon: Beauty Meets Fashion

V. Thai Celebrities at Paris Fashion Week: a Revolution

VI. The K-Pop Factor: BTS and BLACKPINK’s Luxury Fashion Dominance

VII. The Mainstream Media Perspective: A Different Story

VIII. Hashtag Analysis: The Digital Footprint of Fashion

Conclusions: The Future of Fashion Marketing

Key Takeaways

Paris Fashion Week SS26 demonstrates several crucial trends shaping fashion’s future:

- Geographic Diversification: The rise of Thai and broader Southeast Asian celebrities signals luxury fashion’s strategic expansion beyond traditional Western and East Asian markets.

- Social Media Dominance: With 21.13 million mentions, social media has become the primary channel for fashion week conversation, sometimes overshadowing traditional media coverage.

- The Ambassador Economy: Strategic celebrity partnerships, particularly with K-pop and Thai entertainment stars, can generate billions of impressions and directly impact brand visibility.

- The Media Divide: While social media favored K-pop and Thai stars, mainstream media highlighted a mix including Meghan Markle and Sunday Rose Kidman-Urban, showing a divide in coverage between platforms.

- Dior’s Strategic Victory: Christian Dior’s 46% share of voice demonstrates the power of combining heritage luxury with contemporary celebrity strategy and Asian market focus. It’s also due to Jonathan Anderson’s highly anticipated debut collection, which blended heritage elements with modern twists, attracting global attention

- L’Oréal Paris’s “Liberté, Égalité, Sororité” show amplified PFW’s impact, featuring diverse celebrities and emphasizing empowerment, with Becky Armstrong topping influencer mentions.

I. The Numbers: PFW’s Unprecedented Media Dominance

Social Media Reach Dwarfs Other Fashion Weeks

From September 28 to October 7, Paris Fashion Week generated 21.13 million mentions on social media from 14.8 million authors, reaching a staggering total audience of 153.6 million people. The peak occurred during the Christian Dior show on October 1st at 2:40 p.m., when social media activity reached its zenith.

To put this in perspective:

- Milan Fashion Week: 4.96 million mentions, 100.51 million reach

- New York Fashion Week: 2.71 million mentions, 151.7 million reach

Paris Fashion Week generated more than four times the social media mentions of Milan and nearly eight times that of New York, cementing its position as the most discussed fashion event globally. Trends included oversized collars, ruffled gowns, and a dialogue between heritage and innovation. Debuts like Jonathan Anderson at Dior and Matthieu Blazy at Chanel marked new eras for these houses. Celebrity front rows featured Zendaya, Jisoo, and Felix, boosting visibility

Traditional Media Coverage

Beyond social media, PFW generated 35,275 mentions across print, digital, television, and radio outlets during the same period. This significantly outpaced both Milan Fashion Week (14,989 media mentions) and NYFW (17,927 mentions).

Key Statistics Summary:

| Metric | Count |

| Social Media Mentions | 21.1M |

| Social Authors/Contributors | 14.8M |

| Scoial Estimated Reach | 153.6M |

| Mainstream Media Mentions | 35,275 |

Data collected by Onclusive 360 and Onclusive Social monitoring tools, excluding bot-generated mentions

Ready to take your social media listening and media monitoring to the next level? Contact us today to learn how Onclusive’s platform can help you track, analyse, and respond to broadcast coverage with precision and ease.

II. Brand Analysis: The Hierarchy of Fashion Power

Top 15 Most Mentioned Brands at PFW

Out of 113 brands featured during Paris Fashion Week, the share of voice reveals a clear hierarchy, with Christian Dior dominating the conversation:

- Christian Dior* – 46.20%

- Louis Vuitton – 13.94%

- Chanel* – 13.83%

- Celine – 6.88%

- Loewe – 4.98%

- Valentino – 4.05%

- Balenciaga – 2.10%

- Givenchy* – 1.81%

- Saint Laurent – 1.47%

- Mugler – 0.98%

- Maison Margiela* – 0.96%

- Acne Studios – 0.77%

- Lacoste – 0.59%

- Courrèges – 0.46%

- Miu Miu – 0.42%

* Denotes Haute Couture brands

The dramatic drop-off from Dior’s 46% to Louis Vuitton’s 14% reveals a fundamental truth about modern fashion: celebrity partnerships, particularly with K-pop stars and Thai entertainers, have become the single most important driver of social media engagement. Brands in positions 5-15 combined (18.42%) still couldn’t match Dior’s solo performance, demonstrating the outsized impact of strategic ambassador selection.

- Louis Vuitton – 13.94%

- Securing second place with strong representation from BLACKPINK’s Lisa (their newest ambassador), Felix from Stray Kids, and Zendaya. The brand’s 14% share demonstrates the power of diversified celebrity partnerships across different entertainment markets.

- Chanel* – 13.83%

- Nearly tied with Louis Vuitton, Chanel’s performance was driven primarily by longtime ambassador Jennie (BLACKPINK) and historic appointment of Becky Armstrong as their first Thai ambassador. The brand maintained its position as a K-pop favorite while expanding into Southeast Asian markets.

- Celine – 6.88%

- V (BTS)’s appearance generated significant buzz, though the brand’s 7% share represents a notable gap from the top three. This figure reflects both V’s massive individual impact and the transition period under new creative director Michael Rider.

- Loewe – 4.98%

- The Spanish luxury house benefited from appearances by Chinese megastar Wang Yibo, Thai celebrities Junior Panachai and Milk Pansa, and brand ambassador Chen Duling. Their 5% share demonstrates Jonathan Anderson’s successful strategy of cultivating Asian market influence.

III. Why Christian Dior Tops Mentions in Social Media and Digital News

Christian Dior’s impressive 46.20% share of voice is no accident: it’s the result of strategic celebrity partnerships and brand positioning. Under the creative direction of Maria Grazia Chiuri, Dior had already successfully leveraged celebrity ambassadors from around the world, notably from K-pop and Asian entertainment industries.

Today, Christian Dior’s dominance rests on Jonathan Anderson’s debut womenswear collection, which reinterpreted house codes, such as the Bar jacket, with fresh, inclusive proportions. The show attracted a huge audience and featured stars like Jimin (BTS) and Jisoo (Blackpink), making headlines in outlets like The Guardian and The Cut. The social media buzz culminated in fan reactions, montages, and viral moments, while digital outlets celebrated this blend of drama and heritage.

The house has long-standing relationships with Jisoo from BLACKPINK and has recently expanded its influence through partnerships with Thai celebrities like LingOrm (Lingling Kwong and Orm Kornnaphat), who have massive followings in Southeast Asia. Their front-row presence and exclusive content generated millions of hashtags, including #diorss26 (12.4M uses) and #lingormdiorss26 (3.9M uses).

Additionally, Dior’s shows are theatrical productions that transcend fashion—they’re cultural moments. The October 1st show featured elaborate sets and a who’s who of global celebrities, creating peak social media engagement at precisely 2:40 p.m. This is mainly due to the presence of celebrities such as Park Jimin as Global Ambassador, Jisoo, Lingling Kwong, and Orm Kornnaphat.

Social media coverage of Thai celebrities at the Dior SS 26 fashion show

IV. The L’Oréal Paris Phenomenon: Beauty Meets Fashion

“Liberté, Égalité, Sororité” Show Impact

While not a fashion brand, L’Oréal Paris made significant waves during PFW with its “Liberty, Equality, Sisterhood” themed show. The event generated:

- 207,700 social media mentions

- 36 million reach on social platforms

- 1,728 mainstream media mentions

Celebrity Impact at L’Oréal

The top 15 most quoted personalities at the L’Oréal event reveal interesting dynamics:

Top 15 influencers/celebrities by share of voice:

| Name | Share of Voice (%) |

| Becky Armstrong | 85.83 |

| Kendall Jenner | 6.96 |

| Eva Longoria | 2.45 |

| Simone Ashley | 1.44 |

| Aishwarya Rai | 0.98 |

| Anitta | 0.69 |

| Viola Davis | 0.48 |

| Mary Fowler | 0.40 |

| Jane Fonda | 0.13 |

| Cara Delevingne | 0.11 |

| Heidi Klum | 0.11 |

| Helen Mirren | 0.10 |

| Andie MacDowell | 0.08 |

| Gillian Anderson | 0.05 |

| Cindy Bruna | 0.04 |

Becky Armstrong’s lead highlights Thai stars’ rising impact

The overwhelming dominance of Becky Armstrong (85.83%) highlights the explosive influence of Thai celebrities in the Asian-Pacific market. Armstrong, known from Thai GL (Girls’ Love) dramas, has a devoted fanbase that actively engages on social media, generating millions of mentions when she appears at global events.

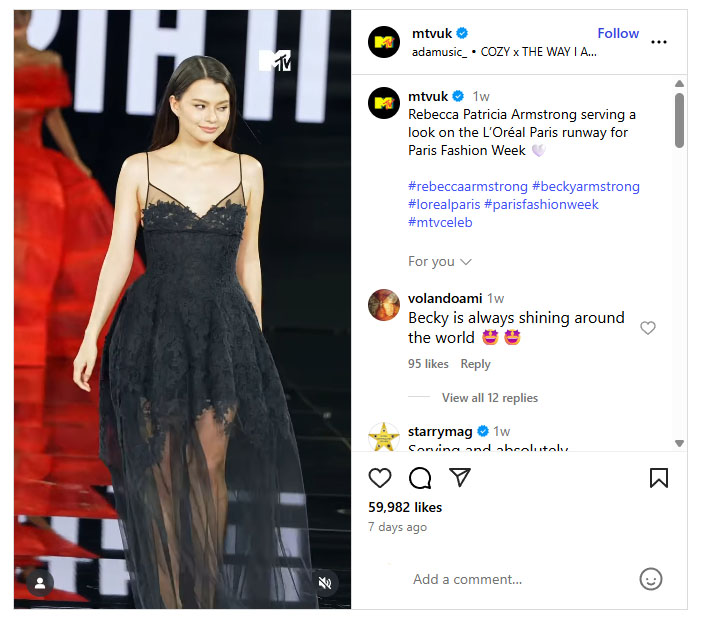

MTV UK Instagram cover: Rebecca Patricia Armstrong models for L’Oréal Paris during Paris Fashion Week.

V. Thai Celebrities at Paris Fashion Week: a Revolution

Understanding the Thai Entertainment Boom

One of the most striking revelations from this year’s PFW data is the dominance of Thai celebrities in social media conversations. Out of 322 analyzed influencers and celebrities, Thai stars claimed multiple top positions:

Top 15 Social Media Influencers at PFW:

Out of 322 analyzed, social media favored K-pop and Thai talents:

| Name and Brand | Share of Voice (%) |

| LingOrm (Lingling Kwong and Orm Kornnaphat) – Dior | 18.10 |

| Jimin (BTS) – Dior | 17.06 |

| Lisa (Blackpink) – Louis Vuitton | 10.79 |

| Lingling Kwong alone – Dior | 9.53 |

| Becky Armstrong L’Oréal-Chanel | 9.03 |

| V/Kim Taehyung (BTS) – Celine | 5.30 |

| Jennie (Blackpink) – Chanel | 5.16 |

| Freen Sarocha – Valentino | 2.68 |

| Felix (Stray Kids) – Louis Vuitton | 2.14 |

| Junior Panachai – Loewe | 1.80 |

| Jisoo (Blackpink) – Dior | 1.71 |

| Milk Pansa – Loewe, Saint-Laurent | 1.68 |

| Joshua (Seventeen) – Givenchy | 1.66 |

| PP Krit – Balenciaga | 1.56 |

| Wang Yibo (Uniq) – Loewe | 0.97 |

The rise of Thai Celebrities at Paris Fashion Week ties to the global popularity of Thai GL dramas and influencers, with stars like Lingling Kwong and Orm Kornnaphat at Dior generating viral content.

Why Thai Celebrities at Paris Fashion Week Are Rising

Several factors explain this phenomenon:

- The GL Drama Explosion: Thai Girls’ Love dramas have exploded in popularity across Asia, with series like “Gap The Series” (starring Freen Sarocha and Becky Armstrong), “The Secret of Us” and “Only You” (starring LingOrm) attracting millions of devoted fans who organize mass social media campaigns.

- Dedicated Fanbases: Thai entertainment fans are incredibly organized and active on social media, creating trending hashtags and coordinating posting campaigns when their favorites attend international events.

- Strategic Brand Partnerships: Luxury brands have recognized Southeast Asia as a crucial growth market. Thailand, in particular, represents a wealthy consumer base with strong luxury consumption habits.

- Cross-Platform Influence: These celebrities maintain strong presences on platforms popular in Asia, including Twitter, Instagram, and Weibo, multiplying their reach.

Excerpt from social media mentions about Milk Pansa and Loewe at PFW. Via Onclusive Social Media Listening Tool.

VI. The K-Pop Factor: BTS and BLACKPINK’s Luxury Fashion Dominance

Why K-Pop Idols Command Fashion Week

K-pop stars, particularly from BTS and BLACKPINK, have become essential to luxury fashion strategy:

- Jimin (BTS) at Dior – 17.06% share of voice

- V/Kim Taehyung (BTS) at Celine – 5.30% share of voice (generated 2.5M uses of #taehyungxceline)

- Lisa (BLACKPINK) at various shows – 10.79% share of voice

- Jennie (BLACKPINK) at Chanel – 5.16% share of voice

- Jisoo (BLACKPINK) at Dior – 1.71% share of voice

These aren’t mere celebrity appearances—they’re strategic brand ambassador relationships. BTS members alone can influence billions in purchasing decisions, while BLACKPINK members have each become synonymous with their respective luxury houses.

VII. The Mainstream Media Perspective: A Different Story

Traditional Fashion Media Focuses on Western Celebrities

Websites of Mainstream fashion publications (Vogue, Marie Claire, Harper’s Bazaar, WWD, Grazia, BOF, FashionNetwork) tell a strikingly different story about who matters at PFW. Unlike social media where Thai celebrities and K-pop stars dominated with concentrated fan engagement, traditional fashion media distributed their coverage more evenly across established Hollywood stars, fashion insiders, and legacy celebrities:

Top 15 in Traditional Media Coverage (digital news) during Paris Fashion Week:

| Name | Share of Voice (%) |

| Meghan Markle | 4.84 |

| Rosé (Blackpink) | 4.68 |

| Kendall Jenner | 3.51 |

| Nicole Kidman | 3.07 |

| Hailey Bieber | 2.22 |

| Lisa (Blackpink) | 2.13 |

| Zendaya | 1.97 |

| Helen Mirren | 1.96 |

| Kylie Jenner | 1.94 |

| Kim Kardashian | 1.91 |

| Heidi Klum | 1.70 |

| Rosalía | 1.55 |

| Emma Stone | 1.53 |

| Sunday Rose Kidman-Urban | 1.47 |

| Pamela Anderson | 1.43 |

Only Lisa from BLACKPINK appears in both top 15 lists (10.79% on social media, 2.13% in traditional media), highlighting a profound divide between social media conversation and traditional fashion journalism priorities. Even more telling, the most-covered celebrity in mainstream media (Meghan Markle at 4.84%) received less attention than 10 different celebrities on social media, where LingOrm alone commanded 18.10%.

Unlike social media’s concentrated attention (where the top celebrity captured 18% of mentions), traditional media spread coverage more democratically. The gap between #1 (Meghan Markle, 4.84%) and #15 (Pamela Anderson, 1.43%) is only 3.41 percentage points—a stark contrast to social media’s 16.67-point gap between #1 and #15.

This distribution reflects traditional fashion journalism’s editorial priorities: covering established A-listers, fashion industry veterans, and culturally significant moments rather than responding to organized fan campaigns and social media virality.

Why Meghan Markle, Rosé, Kendall Jenner, and Nicole Kidman Dominated Traditional Coverage

Meghan Markle (4.84%) The Duchess of Sussex’s fashion week presence generates headlines because she represents the intersection of royalty, Hollywood, activism, and fashion. Traditional media gravitates toward her appearances because they offer multiple editorial angles: royal protocol, political statements through fashion choices, and her influence on global fashion trends. Every Meghan appearance is inherently newsworthy to fashion editors who value legacy and cultural impact over social media metrics.

Rosé (BLACKPINK) (4.68%) As Saint Laurent’s global ambassador, Rosé bridges the gap between K-pop’s massive social media power and traditional fashion credibility. Her nearly equal footing with Meghan Markle (just 0.16 percentage points behind) proves that BLACKPINK’s influence extends beyond fan armies into fashion establishment recognition. Rosé’s solo career success, combined with her sophisticated personal style, makes her coverage-worthy for publications targeting affluent, fashion-conscious readers who may not follow K-pop on social media.

Kendall Jenner (3.51%) As one of the world’s highest-paid supermodels and a fixture at fashion weeks for over a decade, Kendall represents fashion media’s comfort zone. She’s walked for virtually every major house, maintains relationships with top designers, and embodies the “model off-duty” aesthetic that fashion publications love to feature. Unlike influencers who rose through social media, Kendall earned her place through traditional fashion industry channels, making her a natural choice for mainstream coverage.

Nicole Kidman (3.07%) The Oscar-winning actress brings gravitas, elegance, and transgenerational appeal to fashion week. At 58, Kidman represents fashion’s increasingly successful push for age-inclusive beauty standards. Her attendance—often with daughter Sunday Rose—creates multi-generational storylines that appeal to fashion media’s diverse readership. Publications value her because she bridges classic Hollywood glamour with contemporary fashion relevance, and her choices influence luxury consumers across age demographics.

The Kardashian-Jenner Fashion Media Empire

Notably, three members of the Kardashian-Jenner family appear in the top 15 (Kendall #3, Kylie #9, Kim #10), collectively commanding 9.36% of traditional media coverage. This concentration demonstrates the family’s unparalleled ability to generate fashion media interest through their combination of celebrity status, business ventures, styling relationships, and cultural omnipresence.

Excerpt from the digital news coverage of Meghan Markle’s visit to PFW (for Balenciaga). Via Onclusive Social Media Listening Tool.

VIII. Hashtag Analysis: The Digital Footprint of Fashion

The top hashtags from PFW reveal the intersection of brands, celebrities, and events.

| Hashtag | Mentions |

| #pfw | 14,567,665 |

| #diorss26 | 12,456,945 |

| #lingorm | 8,077,456 |

| #dior | 7,816,782 |

| #beckysangels | 6,662,718 |

| #linglingkwong | 6,635,300 |

| #srchafreen | 5,741,267 |

| #ormkornnaphat | 4,386,406 |

| #parisfashionweek | 4,358,226 |

| #lingormdiorss26 | 3,967,775 |

| #lingormdiorairportlook | 3,298,558 |

| #VxCELINEPFW | 3,007,074 |

| #taehyungxceline | 2,508,840 |

| #bts | 2,269,826 |

| #lisa | 2,239,367 |

Excluding bot-generated ones, the top 15 reflect brand and influencer dominance. These underscore Dior’s and Thai stars’ viral power. The prevalence of Thai celebrity hashtags in the top 10 underscores their massive social media impact and organized fanbases.

A X post (and hashtags) by celebrity Thai Orm Kornnaphat, who attended PFW for the Dior SS26 show.

Conclusions: The Future of Fashion Marketing

As luxury brands continue their expansion into Asian markets, we can expect Thai, Filipino, and other Southeast Asian celebrities to play increasingly prominent roles at major fashion weeks. The brands that successfully bridge traditional prestige with digital-native influence will continue to dominate the conversation—both online and in the front row.

Paris Fashion Week SS26 wasn’t just about clothes; it was a masterclass in how luxury fashion is adapting to a globalized, digitally-connected world where a Thai actress can generate more social media impact than a Hollywood A-lister.

Ready to take your social media strategy to the next level? Don’t wait to enhance and support your Social Listening analyses with artificial intelligence-powered functions.