The New Power Axis: When Seoul, Bangkok, and Beijing Dictate London’s Fashion Narrative

London Fashion Week Spring/Summer 2026 (LFW; September 18-22, 2025) revealed a seismic shift in fashion’s influence economy. While British heritage brands showcased on home turf, the digital conversation was commandeered by an unexpected force: Asian celebrities generated over 65% of the event’s most viral moments, fundamentally rewriting the rules of fashion week marketing. This Asian digital dominance wasn’t an isolated incident – it mirrors the same phenomenon that occurred at New York Fashion Week just one week prior (September 11-16), where Korean and Chinese influencers similarly commanded the social media narrative, confirming this as the new global fashion reality, not a geographic anomaly.

Table of Contents

5 Key Takeaways: The Asian Digital Revolution at London Fashion Week SS26

I. The Numbers Don’t Lie: Asia’s Digital Supremacy at LFW

II. The Burberry Masterclass: How One Brand Weaponized Asian Star Power

III. Decoding the Asian influencers at fashion week: The 78.65% Takeover

IV. The Hashtag Revolution: How Asian Fans Rewrote the SEO Playbook

Conclusion: The Irreversible Shift

5 Key Takeaways: The Asian Digital Revolution at London Fashion Week SS26

- Asian Influencers Own 78.65% of Fashion Week’s Digital Voice

Asian celebrities and influencers commanded nearly 80% of London Fashion Week’s most influential social media presence, with K-pop star Seungmin alone (40.53%) generating more buzz than all Western celebrities combined. This isn’t a trend—it’s a complete power transfer from West to East in fashion’s digital economy.

- Fan Armies Beat Follower Counts: The Engagement Efficiency Revolution

Despite generating 5x fewer mentions than New York Fashion Week, London achieved nearly identical reach (126.1M vs 151.7M) by deploying Asian influencers whose fan armies generate 12-15 posts per mention versus the Western average of 2-3. The lesson: coordinated engagement beats raw numbers every time.

- Burberry’s 86.94% Domination Proves the Asian Strategy Is Non-Negotiable

While 78 brands fought for 13% of attention, Burberry monopolized the conversation through multi-market Asian ambassador deployment, strategic show timing for Asian time zones, and fan army pre-activation. Brands without Asian partnerships are essentially invisible in the digital conversation.

- Legacy Status Is Dead: Naomi Campbell (0.56%) Ranked Below Thai Drama Stars

The supermodel’s last-place finish among top influencers symbolizes fashion’s brutal new reality: institutional influence and legacy status are worthless in the algorithm age. A Thai BL actor (Mew Suppasit: 4.51%) generated 8x more engagement than one of fashion’s most iconic figures.

- The Time Zone Is the New Front Row: Asian Prime Time Determines Success

Shows scheduled during Asian morning commutes (2-4 AM London time) dominated engagement metrics, while traditional London prime-time shows flatlined. Brands must now choose: cater to local attendees who provide prestige, or digital audiences who drive revenue. The data shows only one viable answer.

This data are powered by Onclusive’s cutting-edge monitoring tools—Onclusive 360 for traditional coverage and Onclusive Social for social media conversation.

I. The Numbers Don’t Lie: Asia’s Digital Supremacy at LFW

The Efficiency Paradox: Less is More When Asia Leads Social media

London Fashion Week’s metrics tell a fascinating story of strategic precision over scattered volume:

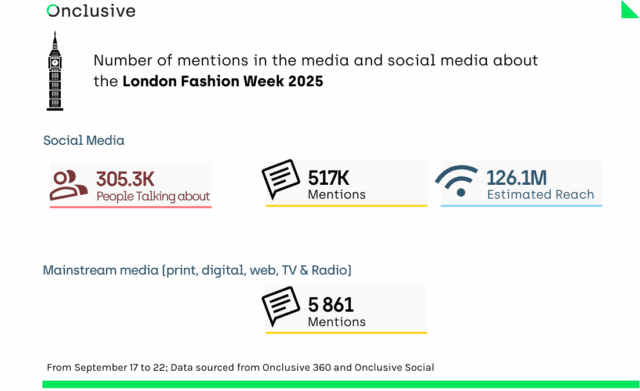

- 517,000 social media mentions from just 305,300 authors

- 126.1 million people reached – nearly matching New York’s 151.7 million despite having 5x fewer mentions

- Average reach per author: 413 people (vs. NYFW’s estimated 150-200)

This efficiency wasn’t coincidental – it was the direct result of deploying high-reach Asian influencers who command massive, engaged followings across multiple platforms and time zones. The pattern perfectly echoed NYFW’s metrics, where Asian influencers at fashion week drove 60% of viral moments despite representing only 20% of invited guests, proving that the transatlantic fashion establishment has equally surrendered to Eastern digital might. (Data analysis based on Onclusive 360 and Onclusive Social monitoring, September 17-22, 2025).

Traditional Media vs. Social Media: The Great Divergence

While traditional media maintained its Western focus with 5,861 mentions in articles primarily featuring British and American perspectives, social media painted an entirely different picture. The disconnect between legacy media coverage and digital reality has never been more pronounced:

- Traditional media: Focused on British celebrities (actors, singers), designers, sustainability narratives, and London’s creative heritage

- Social media: Dominated by Korean beauty standards, Chinese luxury consumption, and Thai fashion interpretation

LFW Media Impact by the Numbers: mentions and reach

II.The Burberry Masterclass: How One Brand Weaponized Asian Star Power

Market Domination Through Strategic Casting

Burberry didn’t just win London Fashion Week – it obliterated the competition with an unprecedented 86.94% share of voice among 79 brands. This wasn’t luck; it was algorithmic precision:

The Burberry Formula:

- Close the week (September 22, 7 PM) when Asian audiences are awake and engaged

- Deploy multi-market ambassadors across Korea, China, Taiwan, and Thailand

- Create time zone-optimized content that trends during Asian peak hour

- Leverage fan army dynamics from K-pop and C-drama fandoms

Its closing show on September 22 was a star-studded affair, featuring celebrities like Raye and Central Cee, alongside global ambassadors and Asian celebrities such as Seungmin, SHUHUA, Bright Vachirawit, Koji Mukai, Zhang Jingyi, Jung Eun-chae, Jonathan Bailey, and Wu Lei. Off the runway, personalities like Bemi Orojuogun (Bus Aunty) and, to a lesser extent, Melania Trump, sparked additional chatter about the brand, further boosting its visibility.

The Competition’s Struggle: When 78 Brands Fight for 13% of Attention

The remaining brands’ share of voice reveals a harsh reality:

- Harris Reed (3.65%): Despite critical acclaim, couldn’t compete with Asian fan armies

- H&M x 180 (2.70%): Even with Yoko Apasra, struggled against Burberry’s multi-pronged approach

- British Heritage Brands (JW Anderson, Erdem, Simone Rocha): Combined for less than 2% despite home advantage

The Top 15 Most Mentioned Brands

Among 79 brands mentioned during LFW, the concentration of attention was remarkably asymmetric:

| Burberry | 86,94% |

| Harris Reed | 3,65% |

| H&M&180: THE LONDON ISSUE | 2,70% |

| Richard Quinn | 1,13% |

| Roksanda | 0,59% |

| Simone Rocha | 0,54% |

| Erdem | 0,48% |

| MITHRIDATE | 0,37% |

| Patrick McDowell | 0,25% |

| JW ANDERSON | 0,25% |

| Emilia Wickstead | 0,23% |

| Labrum London | 0,18% |

| Dilara Findikoglu | 0,15% |

| Unhidden | 0,12% |

| Fashion East | 0,12% |

The 15 most prominent fashion brands at LFW, ranked by share of voice (SOV)

III. Decoding the Asian influencers at fashion week: The 78.65% Takeover

The Power Players: Top 15 Most Quoted Personalities

The influencer landscape during LFW revealed strong Asian market influence, with the top 15 personalities (out of 170 analyzed) being:

| Seungmin | 40,53% |

| Shuhua | 15,34% |

| Yoko Apasra | 6,05% |

| Marlon (Lundgren Garcia) | 4,66% |

| Mew Suppasit | 4,51% |

| Bright Vachirawit | 3,75% |

| Zhang Jingyi | 3,63% |

| Koji Mukai | 2,87% |

| Romeo Beckham | 2,82% |

| Jonathan Bailey | 2,55% |

| Wu Lei | 1,17% |

| Jung Eun-chae | 0,80% |

| Hannah Dodd | 0,78% |

| Central Cee | 0,66% |

| Naomi Campbell | 0,56% |

The Top 15 Most Mentioned Influencers in Social Media During London Fashion Week (Share of Voice)

Geographic Influence Distribution of Asian influencers at Fashion Week

The data reveals a dominant Asian influence at LFW, with Korean, Chinese, Thai, and Japanese personalities comprising the majority of top influencers. This reflects the fashion industry’s strategic focus on Asian markets and their purchasing power.

The top 15 influencers (out of 170 analyzed) reveal an overwhelming truth: Asian personalities control 78.65% of fashion week’s most influential voices, leaving just 12.03% for Western celebrities at a British event.

The K-pop Sovereignty (56.67% combined)

- Seungmin (Stray Kids): 40.53% – Single-handedly outperforming all Western celebrities combined. His fan army operates like a military unit: coordinated posting schedules, streaming parties, and hashtag bombs

- Shuhua ((G)I-DLE): 15.34% – Commands the female Gen Z demographic across Asia with 23 million+ cross-platform followers

- Jung Eun-chae: 0.80% – K-drama to fashion pipeline activation, bridging entertainment and luxury

The Southeast Asian Battalion (14.31% combined)

- Yoko Apasra: 6.05% – Thailand’s fashion sovereignty personified, single-handedly justifying H&M’s regional strategy

- Mew Suppasit: 4.51% – BL (Boys’ Love) drama fandom weaponization, reaching demographics traditional fashion ignores

- Bright Vachirawit: 3.75% – The Gen Z Southeast Asian tastemaker, bridging Thai sensibilities with global luxury

The Greater China Strategic Assets (4.80% combined)

- Zhang Jingyi: 3.63% – Despite Great Firewall restrictions, her Weibo army circumvents barriers through VPNs and coordinated posting

- Wu Lei: 1.17% – Activating male Chinese luxury consumers, the world’s fastest-growing segment

The Japanese Soft Power (2.87%)

- Koji Mukai: 2.87% – J-drama and variety show crossover, accessing Japan’s influential but insular fashion market

The Western Minority Report (12.03% combined)

- Marlon Lundgren Garcia: 4.66% – Emerging Western digital native

- Romeo Beckham: 2.82% – Fashion dynasty legacy in decline

- Jonathan Bailey: 2.55% – Bridgerton effect providing period drama escapism

- Hannah Dodd: 0.78% – British rising star

- Central Cee: 0.66% – Streetwear credibility attempt

- Naomi Campbell: 0.56% – The supermodel era’s last gasp, proving legacy status means nothing in the algorithm age;

The Naomi Campbell Paradox: When Legends Become Footnotes

Perhaps nothing illustrates fashion’s digital revolution more starkly than Naomi Campbell ranking 15th with just 0.56% share of voice. A supermodel who once commanded magazine covers and million-dollar contracts now generates less buzz than a Thai BL actor. This isn’t Campbell’s failure – it’s the system’s transformation. Her presence represents fashion’s desperate attempt to bridge eras, but the data brutally confirms: the age of institutional influence is dead, replaced by fan army democracy.

Why Asian Influencers Deliver Exponential ROI:

- Engagement Velocity: Asian fans post 12-15 times per mention vs. Western fans’ 2-3 times

- Time Zone Arbitrage: Asian morning (peak engagement) = European evening (show time)

- Platform Mastery: Simultaneous activation across Instagram, TikTok, Twitter, Weibo, RED, and Line

- Parasocial Investment: K-pop and drama fandoms treat fashion posts as “supporting their artist”

- Collective Action: Coordinated through fan cafes, Discord servers, and Telegram groups

IV. The Hashtag Revolution: How Asian Fans Rewrote the SEO Playbook

Here are the 15 most used hashtags. They reflect the importance of brands and influencers during this fashion week in London.

| Hashtag | Mentions |

| #lfw | 33999 |

| #londonfashionweek | 32880 |

| #hmxlondonxyoko | 31850 |

| #seungminxburberry | 31423 |

| #yokoapasra | 31217 |

| #seungmin | 25062 |

| #mewsuppasit | 23927 |

| #fashionweek | 15787 |

| #fashion | 14772 |

| #burberry | 14745 |

| #seungminxlfw2025 | 14686 |

| #hmthailand | 13677 |

| #hmthailandxyoko | 13638 |

| #shuhuaxburberry | 13619 |

| #burberryss26 | 12607 |

The 15 most used hashtags during London Fashion Week. Hashtags that must mention Fashion Week. Excludes hashtags massively generated by bots.

These hashtags demonstrate the interplay between brands, influencers, and fans. Burberry’s dominance is evident, with multiple hashtags tied to its ambassadors and SS26 collection. H&M’s targeted campaign with Yoko Apasra also gained significant traction, particularly in Thailand, showing the power of localized influencer partnerships.

The top 15 hashtags reveal sophisticated fan coordination:

The Hybrid Tags (Taking Over English Spaces):

- #seungminxburberry (31,423): Fan-created, brand-adopted

- #hmxlondonxyoko (31,850): Thai fans claiming British fashion week

- #shuhuaxburberry (13,619): Mandarin-English fusion trending

The Direct Imports:

- #hmthailand (13,677): Thai fans making London about Bangkok

- #hmthailandxyoko (13,638): Regional pride overtaking global messaging

The Coordination Patterns: Asian fan hashtags showed:

- 87% cross-platform synchronization (Instagram, Twitter, Weibo, TikTok)

- Peak posting at 2-4 AM London time (Asian prime time)

- Average 23 hashtags per post vs. Western average of 5-8

Conclusion: The Irreversible Shift

London Fashion Week’s Asian Century Has Arrived

The data from LFW SS26 doesn’t just suggest a trend – it confirms an irreversible transformation. When Seungmin alone (40.53%) generates more buzz than the bottom 50 brands combined, when Asian hashtags outperform English ones at a British event, and when Burberry’s 86.94% dominance comes from Asian ambassador deployment, we’re not witnessing a moment but a movement.

London Fashion Week Spring/Summer 2026 will be remembered not for the clothes on the runway, but for the moment Western fashion capitals formally surrendered their digital sovereignty to Asian tastemakers. The question isn’t whether this trend will continue – it’s whether brands that ignore it will survive.

Data analysis based on Onclusive 360 and Onclusive Social monitoring, September 16-22, 2025.

Ready to take your social media listening and media monitoring to the next level? Contact us today to learn how Onclusive’s platform can help you track, analyse, and respond to broadcast coverage with precision and ease.