As the global energy transition accelerates, so does scrutiny of oil and gas companies. Our latest Energy Industry Media Analysis explores 12 months of media coverage and social conversations across eight major global energy brands: Shell, Pemex, ENI, ExxonMobil, TotalEnergies, Repsol, E.ON, and Puma Energy, revealing key insights for industry communicators.

1. The Great Reputation Divide: Public Sentiment Is Polarized

We used Onclusive Social to understand key topics and themes dominating online consumer discussions. Our 12-month analysis reflects a stark division in how energy companies are perceived:

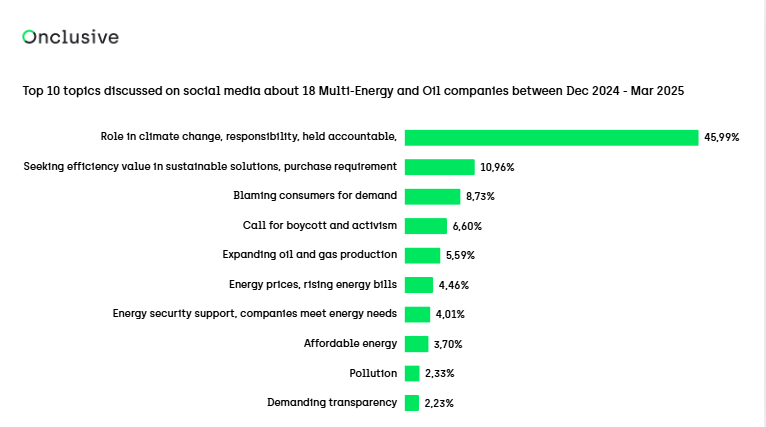

- Climate accountability dominates concerns (46%): Consumers increasingly scrutinize energy companies’ environmental impact, expressing skepticism toward corporate climate commitments. Social media users question the authenticity of net-zero pledges that coincide with fossil fuel expansion or climate policy opposition. This reflects growing expectations for meaningful emission reductions and genuine investment in renewable alternatives like solar, wind, and hydrogen.

- Efficient value in sustainable energy (11%): Consumers increasingly seek efficient, valuable sustainable solutions, calling on multi-energy companies to lead innovation efforts that provide affordable, reliable, and environmentally responsible energy. These messages reflect expectations for genuine commitment to energy transition rather than superficial changes.

- Activism gains momentum (7%): Beyond criticism, social media platforms (X, TikTok, and Instagram) feature prominent activism and boycott calls, with rallying hashtags like those of the #JustStopOil movement demanding an end to new oil and gas projects.

- Consumer frustration centers on profits (2%): Public frustration centers on oil companies reporting substantial profits while consumers struggle with escalating energy costs. Social media messages reveal widespread concern over this perceived disconnect between corporate gains and household financial strain.

- Support remains for energy security(4%): A sizable portion of social media posts favor expanded oil and gas production, reflecting concerns about energy security and economic benefits, particularly regarding the Trump administration’s “drill, baby, drill” policy. This support indicates that many users view oil companies as essential to meeting energy needs and maintaining stable prices.

2. Shell Dominates the Conversation, For Better or Worse

Our Share of Voice analysis reveals Shell’s overwhelming media presence among the energy brands we studied:

- 7 million social media mentions and 730K mainstream media mentions over 12 months.

- Criticism for contradictory messaging: Shell faces backlash for promoting environmental initiatives while maintaining substantial fossil fuel operations.

- Strategic social media presence: Shell’s influencer partnerships have become a significant driver of public discourse.

3. Renewable Energy Investment: Promise vs. Practice

Energy companies face increasing scrutiny over their renewable commitments:

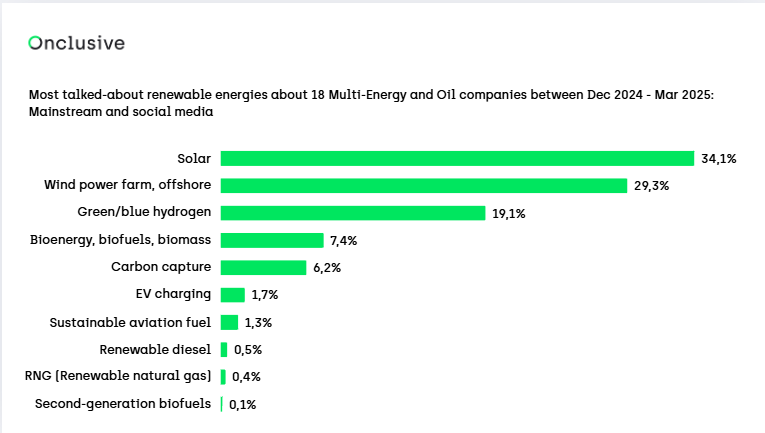

- Solar (34%) and Wind (29%) lead renewable investment conversations, with Green/Blue Hydrogen (19%) emerging as the third most discussed renewable technology.

- Diverse transition strategies emerge: The report reveals distinct approaches to renewable investment among major players:

- TotalEnergies leads the transition: While pursuing a diversified renewable portfolio (solar, wind, bioenergy, hydrogen, storage), TotalEnergies continues expanding with projects like its $160 million German battery initiative.

- Shell retreats from renewables: Shell has scaled back investments in wind, solar and biofuels, pivoting toward its traditional fossil fuel operations.

- ENI balances multiple approaches: ENI maintains a “satellite model” that spins off business units like Enilive and Plenitude to attract investment while retaining control.

- Oil-free E.ON: As a utility without oil operations, E.ON leads in wind, solar and storage development.

4. President Trump’s Policies Create Market Contradiction

The political landscape has created a complex operating environment:

- “Drill, Baby, Drill” rhetoric meets market reality: Despite President Trump’s January 2025 policies aimed at boosting oil production, companies remain cautious and prioritize profitability over production surges.

- Tariff wars impact operations: Trump’s tariffs on Chinese goods have created market instability, with retaliation reducing U.S. oil exports.

- Peak demand concerns persist: The industry faces the reality of peak demand forecasted around 2027 due to accelerating EV adoption.

5. Media Coverage Focuses on Industry’s Balancing Act

Using Onclusive’s media monitoring platform, we identified that mainstream media narratives center on three key themes:

- Diversification and renewable investment: 11% of media coverage focuses on energy companies’ transition strategies.

- Stock market performance and shareholder returns: 9% of coverage analyzes financial results and investor relations.

- Deregulation impact: 9% of coverage examines how policy changes under the Trump administration affect operations and long-term strategy

6. Technological Innovation Reshapes Industry Conversations

The report shows significant focus on how technology is transforming energy operations and communications:

- AI and automation lead tech discussions (7%): Mainstream media coverage highlights technological innovation as the fourth most discussed topic, with AI, automation, drones, and big data applications transforming operations.

- Social media amplifies tech narratives: Companies leverage digital platforms to showcase innovation, with hashtags like #energytransition (2% of ENI’s mentions) and #sustainability (3% of TotalEnergies’ mentions) connecting technological advancements to broader goals.

- Partnerships drive innovation coverage (7%): Media analysis reveals three types of technology partnerships receiving significant attention:

- Industrial partnerships for production and distribution optimization

- Technology collaborations with AI and data analytics companies

- Cross-sector alliances with companies specializing in battery technology and storage solutions

- Customer-facing tech gains traction: EV charging infrastructure (2% of renewable discussions) and smart energy management systems feature prominently in consumer-focused media coverage.

Final Thought

The energy industry faces an unprecedented reputation paradox in 2025: record profits amid growing public skepticism. Our data shows an industry caught between Trump-era deregulation and accelerating climate expectations, between shareholder demands and consumer criticism.

Forward-thinking energy communicators must move beyond superficial sustainability messaging to address the 46% of conversations demanding real climate accountability. As mainstream media increasingly covers both transition strategies (11%) and financial performance (9%), companies that leverage real-time sentiment tracking and engage authentically with critics will secure both public trust and business resilience.

Download our complete Energy Industry Media Analysis 2025 for the full insights.