The rise of GLP-1 weight loss medications, such as Wegovy and Ozempic are revolutionizing weight management. This development brings both opportunities and threats for many industries, with the Food & Beverage sector being particularly affected. Media coverage provides crucial insights into how companies are responding to the rise of GLP-1 weight loss medications and how their strategies are being perceived by the public and industry experts.

In our recent report, “Food & Beverage CEOs and Their Brands in the Media,” we analyzed media coverage of leading global Food & Beverage industry CEOs and their companies to understand the key issues shaping the industry. A significant theme that emerged was the impact of GLP-1 weight loss drugs. This blog post explores this topic in more detail

For our mainstream media analysis, we used Onclusive’s media monitoring tool to focus on seven major brands and their CEOs from our report:

- Danone

- Diageo

- Glanbia

- Mondelez International

- Nestlé

- PepsiCo

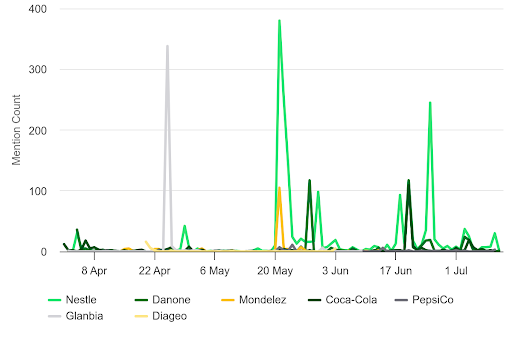

GLP-1 & Food & Beverage Brands Media Mentions Over Time

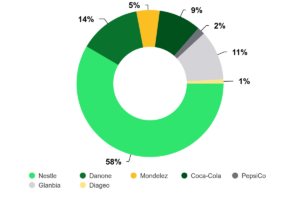

Onclusive’s media monitoring tool revealed that between April 1 and July 11, 2024, there were 3,610 mainstream media mentions of GLP-1 in connection with the seven brands analyzed. Nestlé emerged as the clear leader, accounting for 58% of the total Share of Voice (SoV) with 1,954 mentions. Danone followed with 14% SoV, and Glanbia came in third with 11%.

Key Insights from our Media Monitoring Analysis

Nestlé:

On May 21, Nestlé’s media coverage peaked following the announcement of its new “Vital Pursuit” product line aimed at GLP-1 drug users. This line includes whole grain bowls, protein pasta, sandwich melts, and pizza designed to support weight management efforts. This follows suit with health companies that plan to launch similar products this year.

On June 25, the brand had a significant surge in media coverage when Nestlé Health Science launched its GLP-1 nutrition platform – a new web platform that provides comprehensive support for people on GLP-1 medications.

Danone:

Danone gained 453 mainstream media mentions. On May 28, Danone featured in headlines including “Wellness Supplements Market Size to Worth USD 454.86 Bn By 2031”, though these mentions were not highly significant. However, on June 20, Danone was frequently cited in headlines alongside other brands in our analysis: “Nestle, Coke, Danone take cautious approach to catering to Ozempic users”

Glanbia:

Glanbia achieved 369 article mentions overall. On April 25, the brand saw a peak in coverage (340 mentions) when it was discussed alongside Nestlé in articles about the potential threat of weight loss drugs like Ozempic and Wegovy to the diet industry.

Food & Beverage industry leaders are beginning to acknowledge the potential impact of GLP-1 medications. However, only a few are actively contributing to and shaping their brand’s narrative on this topic.

Nestlé CEO Ulf Mark Schneider

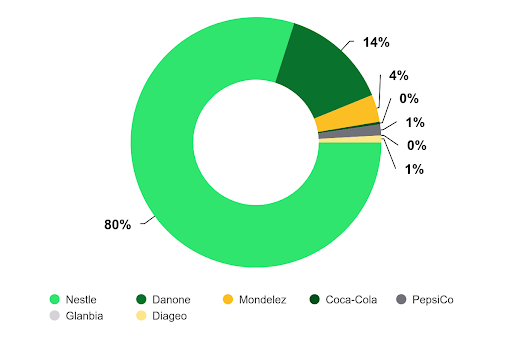

Most CEOs in our list were not heavily featured in mainstream news coverage on this topic during the analyzed time frame. However, Nestlé CEO Ulf Mark Schneider was an exception, accounting for 80% SoV with 454 mentions. He was quoted in articles with headlines such as “What do weight-loss drugs mean for a diet industry built on eating less and exercising more?” Schneider remarked, “Diets are cool again. It’s something that people used to do quietly on the side, uncertain about their outcomes.”

Danone CEO Antoine de Saint-Affrique

Antoine de Saint-Affrique received 79 mentions. In April, he was quoted in headlines downplaying the threat of weight loss drugs to food producers: “We see ourselves as extremely complementary,” he said, emphasizing Danone’s role in providing essential proteins.

Mondelez CEO, Dirk Van de Put

Despite Mondelez International sitting in third place with 5% of the global SoV regarding GLP-1 drugs, it’s CEO, Dirk Van de Put, continues to shrug off worries that weight loss drugs will impact the food industry saying that he expects that in 10 years, the drug’s effect on sales volumes will equate to a “margin of error”—between 0.5% and 1% – echoing the comments that other major brands made at the end of 2023. However, Mondelez has been quoted as saying that its snack bars fit perfectly into the diet of a GLP-1 patient in articles that discuss the launch of Nestlé’s pizza range for Ozempic users.

Coca-Cola CEO James Quincey

James Quincey was featured in a few articles, noting the industry’s shift towards health and wellness and the opportunity to innovate and offer more health-conscious products. Similarly, PepsiCo CEO Ramon Laguarta received little coverage in the analyzed period but had previously downplayed the threat of GLP-1 drugs to PepsiCo’s business.

What’s Next for the Food & Beverage Industry?

GLP-1 weight loss medications present a dynamic challenge and opportunity for the Food & Beverage industry. Companies that can adapt to changing consumer preferences, innovate new product lines, and effectively market their offerings stand to benefit. Whether those who are reliant on traditional, high-calorie products will face bottom line impacts remains to be seen.

To find out more about what other topics are driving mainstream media coverage and social media conversations about the world’s leading Food & Beverage brands and their CEOs, download our report: Food & Beverage CEOs & Their Brands in the Media.

Learn more about our media monitoring tools and how they can provide critical insights for your strategies. Contact us for a demo.