The Santander UK exit story dominated headlines in early 2025 after a Financial Times report suggested the Spanish banking giant was considering pulling out of the UK market. The article pointed to rising regulatory burdens and weak returns as potential reasons for the move.

Shortly after, Santander’s Executive Chair Ana Botín publicly denied the claims, stating: “The UK is not for sale. It remains a core market.” Yet despite the denial, the story had already taken hold in the media and on social platforms.

Why is there Concern about a Santander UK Exit?

The story broke amid reports of multiple challenges in the UK market. The bank faces lower returns compared to its operations in the US, Mexico, and Spain, while grappling with high operational costs. Additional pressures include regulatory requirements from the UK’s ring-fencing regime and recent court rulings on car finance commissions.

Is Santander Really Leaving the UK?

Santander has operated in the UK for more than two decades. It entered the market through a series of acquisitions, including Abbey National, Alliance & Leicester, and parts of Bradford & Bingley. Today, Santander UK serves 14 million customers and manages a mortgage book worth around £175 billion.

The scale and legacy of its UK operations made the Santander UK exit story especially impactful. Even though the bank denied any plans to leave, the combination of performance challenges, regulatory pressure, and leadership changes gave the rumour momentum.

For communications teams, this highlights a key lesson: unconfirmed but high-impact stories must be taken seriously from the outset.

Why the Santander UK Exit Story Escalated So Quickly

Several elements combined to accelerate media and public interest in the Santander UK exit story:

- Regulatory pressure. UK ringfencing rules continue to impose structural and cost burdens on large banks.

- Weak performance. In 2024, Santander UK reported a 38% drop in pre-tax profits, while the group’s operations in Spain, Mexico, and the US remained strong.

- Leadership transitions. The planned departure of UK Chairman William Vereker and Ana Botín’s public remarks about the UK’s low returns added weight to the speculation.

Together, these factors shaped a compelling narrative that spread quickly across outlets and platforms. This is a strong reminder that even small cues can fuel large-scale media speculation when not addressed strategically.

Why It Matters for Reputation Management

Speculation, even when false, can damage reputation and trust. Once a narrative is picked up by major media, controlling the message becomes much harder. This can lead to:

- Loss of brand control in the media

- Conflicting messages across internal and external channels

- Anxiety among employees, customers, and investors

- Increased regulatory scrutiny

Media Impact of the Santander UK Exit Story

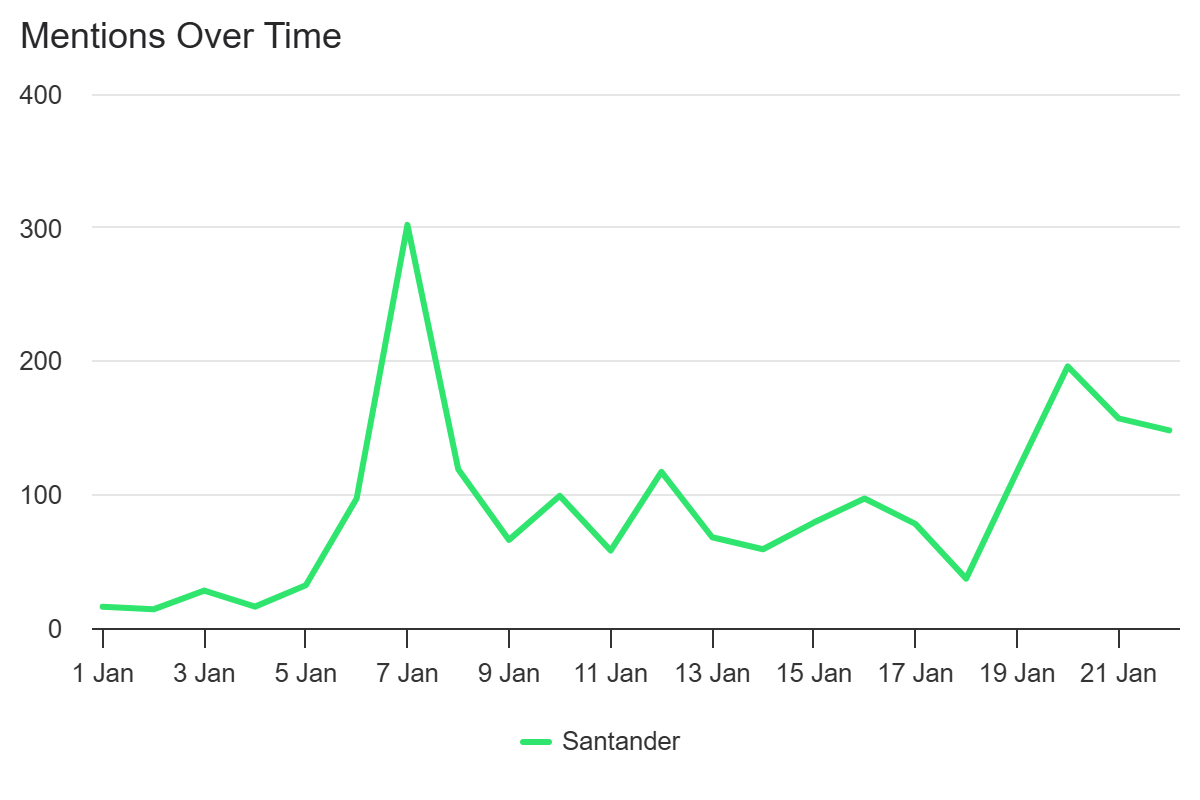

Our mainstream media monitoring analysis shows the impact of the story:

- Coverage surged following reports of a potential Santander UK exit – almost 200 mainstream media mentions on 20 January. However, the spike began to subside by 21 January.

- The highest peak occurred on 7 January (300 mentions), when Santander released results of a survey, showing that only one in four young adults leave school with a solid financial education.

UK Mainstream Media Article Mentions about Santander: Jan 2025

Social Listening Analysis:

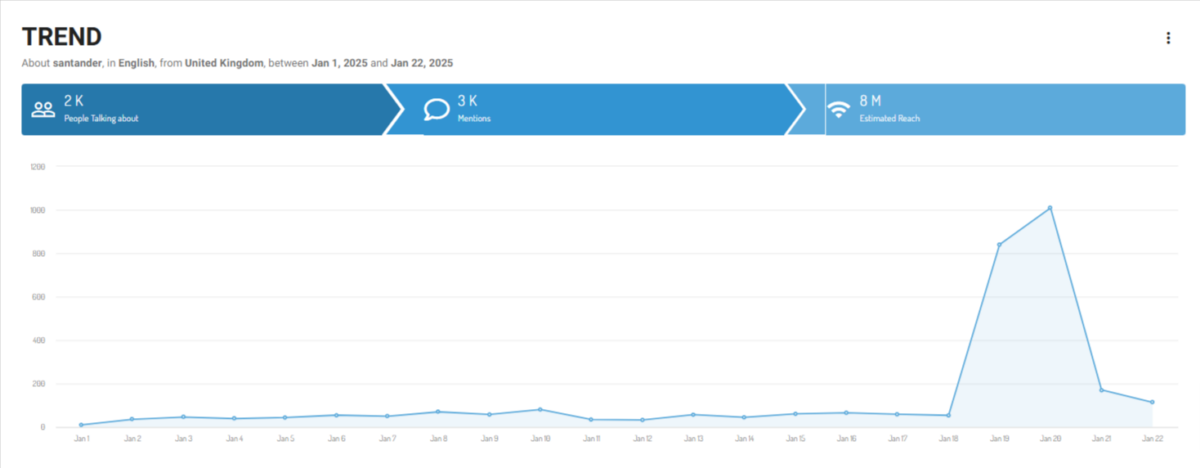

Our social listening analysis shows:

- An 18-fold increase in social media mentions between 18-20 January.

- Peak activity hit over 1,000 mentions on 20 January.

- Discussion diminished significantly by 21 January, returning to nearly normal levels by 22 January. Unlike mainstream media where the story continued to develop.

Source: Onclusive

What Communications Teams Can Learn

When faced with a high-profile story like the Santander UK exit speculation, communications leaders need to act quickly and decisively. Here are three critical actions:

Prepare for different scenarios

- Develop messaging frameworks for a range of possibilities, whether it’s a confirmed exit, partial divestment, restructuring, or denial.

- Create holding statements, FAQs, and employee talking points in advance.

Segment your stakeholders

- Tailor messages to each audience:

- Regulators need clear, timely updates that signal compliance and continuity

- Employees need reassurance and transparency

- Media and customers need consistent public messaging to reduce speculation

Coordinate executive visibility

- Choose a lead spokesperson and ensure all senior leaders are aligned in what they say and when they say it.

- Botín’s consistent messaging across multiple outlets helped calm the narrative and reassert control.

How Media Intelligence Can Help Manage Speculative Stories

Robust media intelligence is vital for detecting and managing stories like the Santander UK exit. Real-time insights help you monitor the evolution of a story and guide your response with data.

Key capabilities include:

- Volume and sentiment tracking to detect early warning signs

- Narrative mapping to understand how stories change across platforms

- Spokesperson tracking to assess the reach and impact of executive comments

- Influencer monitoring to identify which media voices are driving the conversation

Onclusive’s tools provide visibility into all of these areas, helping you respond faster and more strategically when reputational risk emerges.

Final Takeaway: Be Prepared, Not Just Reactive

Speculation about big brands is inevitable. What matters is how well prepared you are when it happens.

Public denials are often necessary but rarely enough on their own. The real differentiator is having a plan, monitoring media in real time, and delivering a unified message across stakeholders.

The Santander UK exit story may have been short-lived, but its impact was immediate. For communications teams, it’s a reminder that being informed, agile, and insight-driven is the best defence against reputational risk.