Introduction: Oil Companies media landscape

In our latest energy company media landscape analysis report 2024-2025, alongside other sections on consumer sentiment and the share of voice of major oil companies, we look at the challenges, trends and technological innovations most discussed on social media and in the mainstream media about the oil industry.

Giant Dominance and Share of voice

In today’s media landscape, Shell is the undisputed conversation leader, capturing attention with 7 million mentions on social networks and 730,000 mentions in traditional media. This overwhelming dominance reflects not only the company’s global reach, but also the controversies that surround it, notably the discrepancy between its environmental rhetoric and its fossil fuel operations.

A distant second, but still significant, is Pemex, with 3.9 million social mentions and 123,000 traditional media mentions. The Mexican oil company is receiving particular attention due to its considerable financial difficulties and the reforms undertaken by its new president Claudia Sheinbaum.

ENI completes the podium with 1.3 million social mentions and 213,000 mentions in the mainstream media, attracting attention for its innovative business model and major gas discoveries.

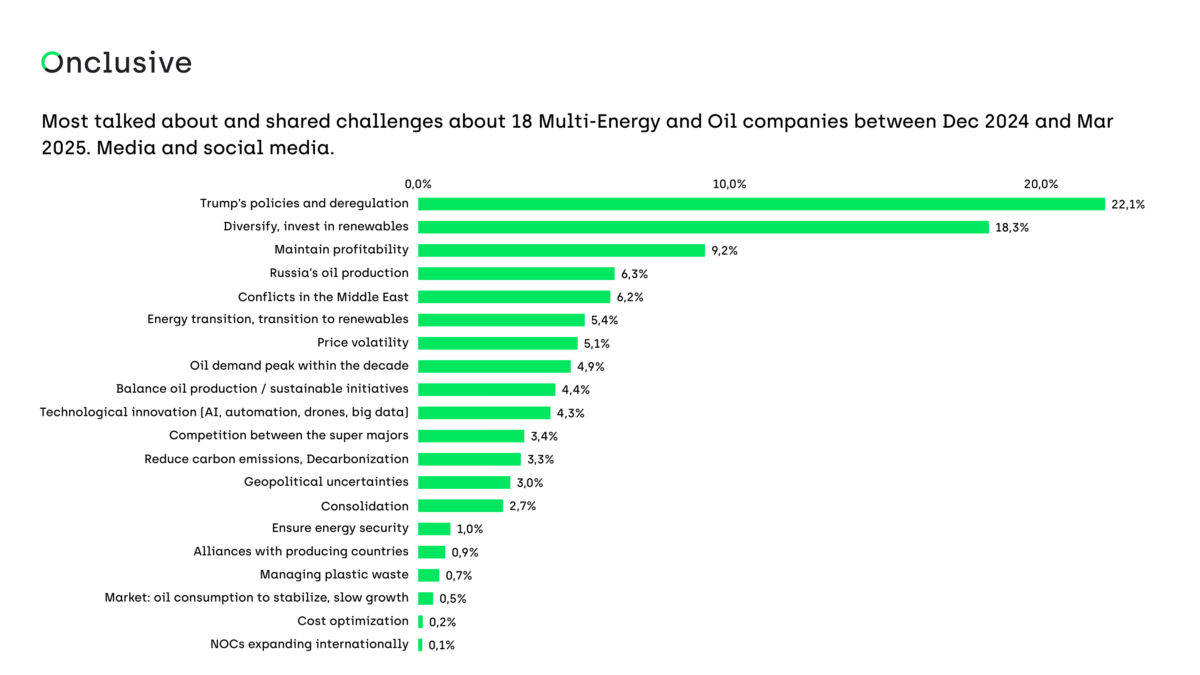

[1] Most talked about and shared challenges about 18 Multi-Energy and Oil companies between Dec 2024 and Mar 2025. Media and social media. Source: Energy Industry Media Analysis 2025

Key Moments that Shaped Media Attention

The year 2024-2025 saw several peaks in media attention that revealed the dynamics of the sector. May 2024 stood out as a particularly intense month, marked by the announcement of Shell’s record profits ($7.7 billion for one quarter) and statements by the Mexican government touting the modernisation of Pemex with an alleged 25% increase in profits.

In July 2024, Shell caused shockwaves by suspending construction of one of Europe’s largest biofuel plants, illustrating the difficulties of the alternative energy market. October was also a crucial month, with TotalEnergies announcing that the next wave of LNG supplies would be postponed until 2027, and Repsol deciding to suspend its investments in green hydrogen in Spain.

These moments of intense media attention reflect the fundamental tensions running through the sector: the precarious balance between immediate profitability and the transition to a more sustainable future.

Climate at the Heart of Social Media Concerns

An analysis of conversations on social networks reveals a dominant concern: the role of energy companies in climate change. This topic accounts for almost half (46%) of all discussions, reflecting heightened public awareness and growing expectations of these major players.

Consumers are increasingly scrutinising the environmental impact of oil companies, expressing scepticism about corporate climate commitments. This distrust extends particularly to promises of carbon neutrality that coexist with the expansion of fossil fuel activities.

Other significant issues include the search for effective sustainable solutions (11%), the tendency of companies to shift responsibility onto consumers (8.7%), and calls for boycotts and activism (6.6%). Public frustration is also palpable over the oil companies’ substantial profits in the face of rising energy costs for households.

Structural Challenges facing the Oil Sector

The energy industry is facing considerable challenges, the most talked about of which remains the Trump administration’s deregulation policies (22.1% of mentions). Although these policies aim to strengthen oil companies through simplified permits and greater access to federal lands, they are paradoxically creating an environment of uncertainty. Oil producers are cautious despite the favourable presidential rhetoric, favouring market discipline and profitability over a massive increase in production.

Diversification into renewable energies is the second major challenge (18.3%), illustrating the growing pressure to reduce carbon footprints and meet global climate targets. This transition is accompanied by a fundamental dilemma: maintaining profitability (9.2%) while investing in technologies that are still maturing.

Geopolitical uncertainties complete this complex picture, with the impact of Russian oil production (6.3%) and the consequences of the conflicts in the Middle East (6.2%) continuing to have a significant influence on the global energy market.

The Energy Transition: between Ambition and Economic Reality

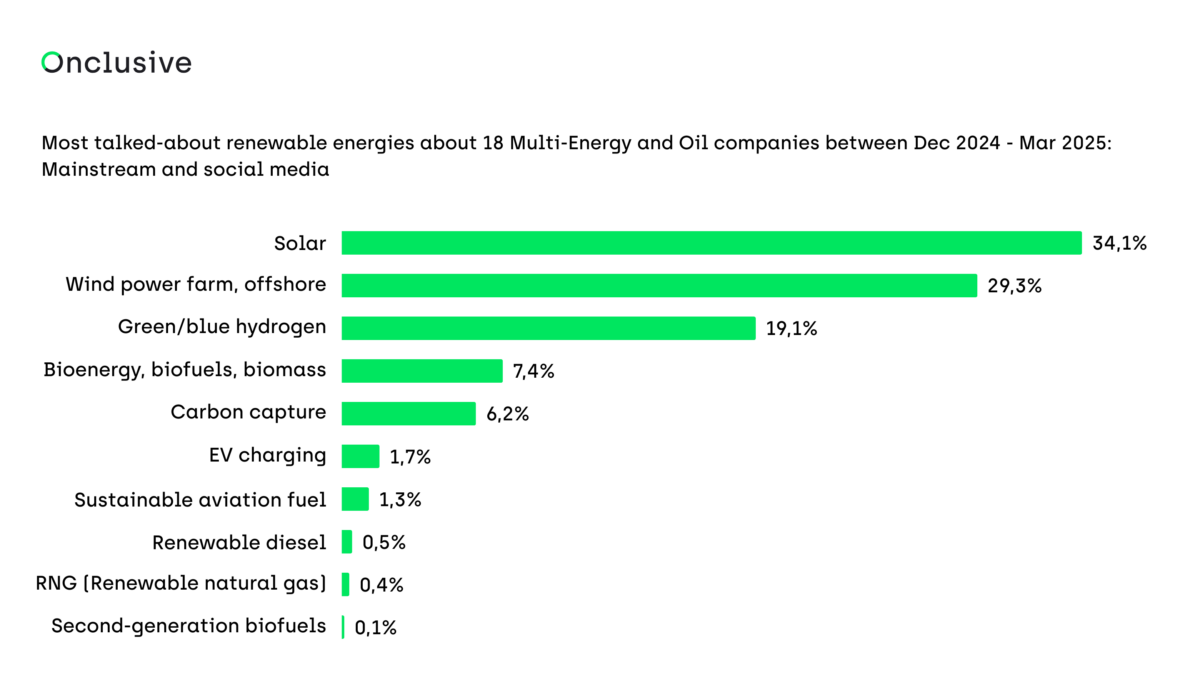

Faced with these challenges, energy companies are developing a variety of transition strategies. Solar energy (34.1%) dominates renewable investments, followed by wind power (29.3%) and hydrogen (19.1%). This diversification reflects a search for a balance between traditional lucrative activities and the necessary adaptation to a less carbon-intensive future.

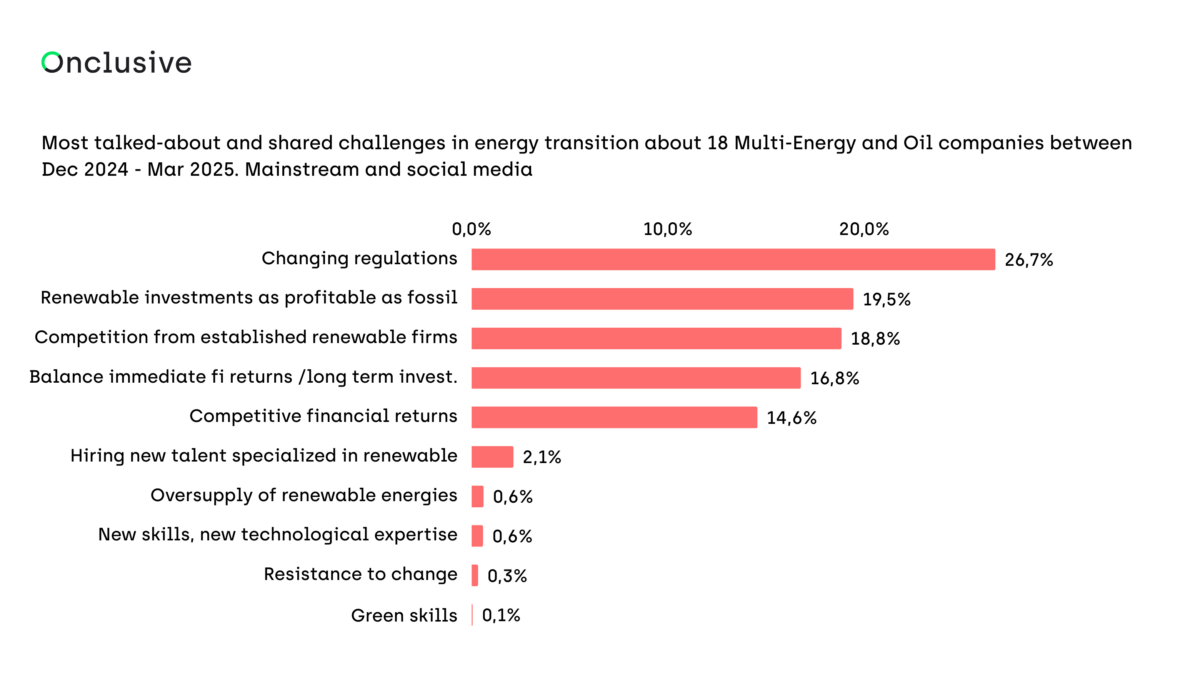

However, this transition is coming up against significant obstacles, mainly changing regulations (26.7%), which create an environment of uncertainty that is not conducive to long-term investment. The profitability of renewable projects (19.5%) relative to traditional activities also remains problematic, while competition from companies specialising in renewable energies (18.8%) is making the positioning of the incumbents even more complex.

Corporate reactions illustrate these tensions: BP has drastically reduced its renewable investments by more than $5 billion for 2025, while TotalEnergies is the exception, continuing to expand in this area, notably with a $160 million battery initiative in Germany.

In this rapidly changing energy landscape, companies are navigating between the contradictory pressures of financial markets, regulators, consumers and the reality of climate change. Media coverage, dominated by issues of energy transition, financial performance and regulatory adaptation, reflects these fundamental tensions that will shape the future of the sector.

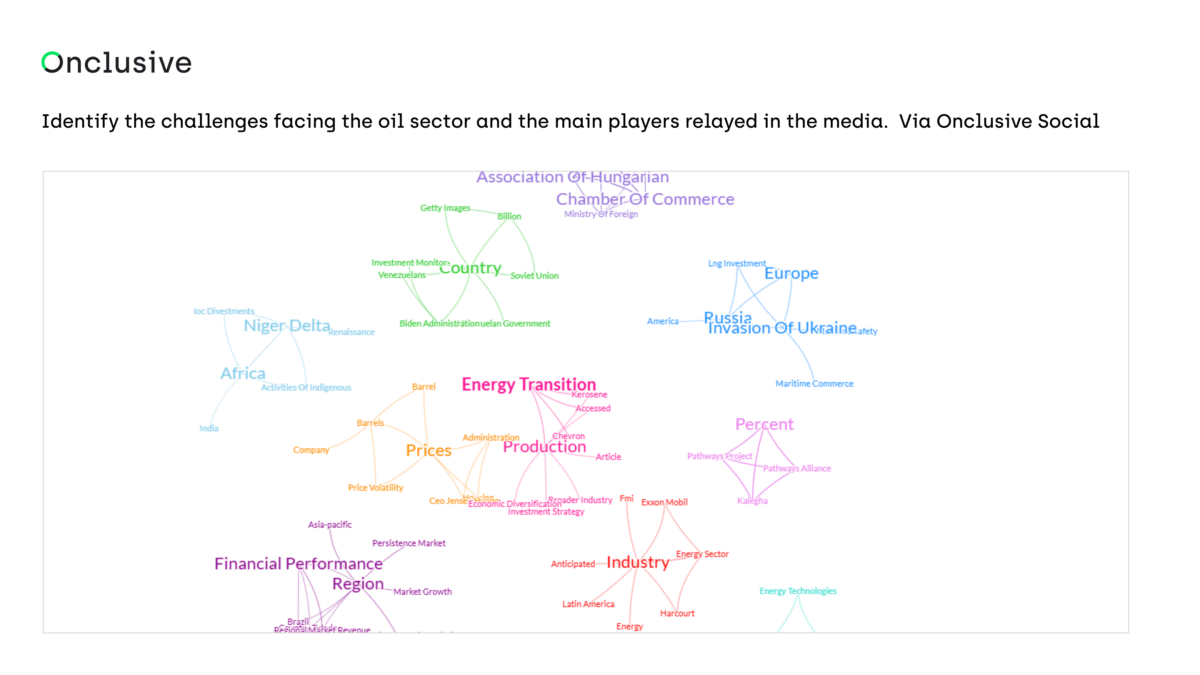

[2] Identifying challenges facing the oil industry and the main players relayed in the media. Via Onclusive Social

Let’s take a closer look at 4 major trends reported in the media and on social media that are shaping the oil industry sector:

I. BP, Shell, ExxonMobil: The challenge of Energy Transition and Diversification

The challenge for energy companies to diversify their activities towards renewable energies—such as solar, wind, and hydrogen—while maintaining profitability, even as oil remains a major source of revenue, is a complex balancing act. This difficulty arises primarily from the significant disparity in profitability between traditional oil operations and renewable energy projects. Oil continues to be a highly lucrative business, often delivering internal rates of return (IRRs) of 15-20%, whereas renewable energy investments typically yield lower returns, ranging from 5-10%. This gap makes it financially risky for companies to shift substantial resources to renewables without jeopardizing their economic stability, especially since the transition requires significant upfront capital and long-term strategic planning. Furthermore, the oil and gas sector benefits from high barriers to entry due to its capital-intensive nature, whereas renewables face lower barriers, leading to increased competition and further pressure on profitability.

Compounding the challenge is the need to avoid disruptions to core oil-based operations, which remain a critical revenue stream. Companies must carefully manage their investment portfolios to ensure that funds allocated to renewables do not undermine the cash flow generated from oil, which often finances the transition itself. External factors, such as fluctuating commodity prices, evolving regulations, and technological advancements, add additional layers of complexity, requiring companies to adapt their strategies dynamically. Despite these hurdles, many energy companies are pursuing diversification into renewables, leveraging their existing resources and expertise to build a sustainable future while preserving short-term profitability.

Examples of Energy and Oil Companies Investing in Renewable Energies

Several major energy companies are actively addressing this challenge by investing in renewable energy sources while continuing to rely on oil revenues to maintain financial health. Below are examples of such companies and their strategies:

TotalEnergies: a leader in the energy transition

TotalEnergies, the French oil major, is aggressively expanding into solar, wind, and hydrogen, with an ambitious target of achieving 100 gigawatts (GW) of renewable energy capacity by 2030. The company is acquiring stakes in solar and wind projects worldwide and investing in hydrogen as a future energy solution. By maintaining its profitable oil and gas operations, TotalEnergies uses these revenues to fund its renewable ambitions, positioning itself as a leader in the energy transition.

BP: solar, wind, and biofuels, but reduces its goals

BP has set a goal to develop 50 GW of renewable energy capacity by 2030 while continuing to operate its oil and gas projects. The company is investing in solar, wind, and biofuels, often through partnerships with renewable energy developers. BP’s approach involves a gradual shift toward cleaner energy, ensuring that its oil and gas operations provide the necessary cash flow to support this diversification without sacrificing profitability.

But BP has notably retreated from its earlier renewable energy goals. Under former CEO Bernard Looney, the company had set a target to increase its renewable energy generation 20-fold by 2030, aiming for 50 gigawatts (GW) of capacity, while simultaneously cutting oil and gas production by 40%. However, this plan has been largely abandoned. BP has scrapped its 50 GW renewable target and now aims for a more modest 15 GW by 2030. The company is also reducing its annual investment in renewables to between $1.5 billion and $2 billion, a significant decrease from earlier plans that exceeded $7 billion annually.

This shift is accompanied by a renewed focus on fossil fuels, with BP planning to boost oil and gas investments by approximately 20%, reaching $10 billion per year.

Shell: solar, wind, and hydrogen and a big shift

Shell is investing in solar, wind, and hydrogen, aiming to become a net-zero emissions energy business by 2050. The company has made significant acquisitions in the renewable sector, including solar and wind projects, and is exploring hydrogen as a key component of its energy mix. Shell balances these investments with its still-profitable oil and gas operations, using the latter to finance its long-term clean energy goals.

Shell has similarly scaled back its renewable energy ambitions. In 2022, the company invested $3.5 billion in its “renewables and energy solutions” division, accounting for 15.3% of its total capital expenditure. By 2023, this figure dropped to $2.7 billion, or just 11.7% of its spending. Shell has also exited several renewable projects, including offshore wind ventures in Ireland and France, signaling a retreat from expanding its renewable portfolio.

Eni: solar, wind, and biofuels

Eni, the Italian energy company, is targeting 15 GW of renewable energy capacity by 2030 through investments in solar, wind, and biofuels. Additionally, Eni is exploring carbon capture and storage (CCS) and hydrogen to complement its renewable efforts. The company relies on its oil revenues to fund these initiatives, maintaining a dual focus on traditional and renewable energy to ensure financial stability.

[3] Most talked-about renewable energies about 18 Multi-Energy and Oil companies between Dec 2024 – Mar 2025: Mainstream and social media. Source: Energy Industry Media Analysis 2025

Chevron: returns from fossil fuels

Chevron has made only limited investments in renewable energy, continuing to prioritize its oil and gas operations. While it has a small renewables portfolio and has explored CCS and technologies like electric vehicle charging, these investments are minor compared to its spending on traditional energy sources. Chevron’s strategy remains centered on maximizing returns from fossil fuels.

Equinor: offshore wind

Norway’s Equinor is aiming for 4-6 GW of renewable energy capacity by 2026, with a strong emphasis on offshore wind, where it leverages its expertise from offshore oil and gas operations. The company adopts a pragmatic approach, balancing its renewable investments with continued oil and gas production to safeguard profitability during the transition.

Repsol: solar, wind, and green hydrogen

Repsol, the Spanish energy company, stands out as the most proactive among these firms in investing in renewable energies. It has increased its targets for installed renewables capacity, ranking highly among energy majors for its ambitions. Repsol is involved in the OGCI and is pursuing diverse projects, including solar, wind, and green hydrogen initiatives (e.g., a 100 MW electrolyzer). It is also developing biofuel and renewable diesel plants, such as facilities in Cartagena and Puertollano. These efforts highlight Repsol’s significant shift toward a broader energy portfolio that balances renewables with its traditional oil and gas operations.

E.ON: wind and solar power

E.ON, a major European energy company has positioned itself as a key player in Europe’s renewable energy landscape, focusing primarily on wind and solar power, alongside investments in energy networks and customer solutions. The company has been involved in developing offshore wind farms and solar projects, contributing to the European Union’s goal of expanding renewable capacity. These efforts align with the EU’s ambitious targets to reduce greenhouse gas emissions and increase the share of renewable energy in its energy mix.

Historically, E.ON has emphasized decarbonization and the integration of renewables into the energy grid, a critical step given the growing demand for clean energy

Pemex: sticking to traditional energy sources

Pemex, Mexico’s state-owned oil company, has minimal investment in renewable energies and remains heavily focused on fossil fuels. As the world’s most indebted state oil company, Pemex faces significant financial challenges that limit its ability to pivot toward renewables. Its investment policy prioritizes oil and gas production, and there is little evidence of substantial efforts to diversify into renewable energy sources like solar, wind, or hydrogen. This focus aligns with a broader trend among nationalized oil companies sticking to traditional energy sources, while private firms adapt to the energy transition.

ExxonMobil: core fossil fuel business

ExxonMobil is making some investments in energy transition technologies, though its primary focus remains on oil and gas. The company is part of the Oil and Gas Climate Initiative (OGCI), which targets net zero emissions by mid-century. ExxonMobil is funding research into algae biofuels and pursuing projects in carbon capture and storage (CCS), hydrogen, and biofuels. Its plans to 2030 include investments in lower-emission technologies and high-value products, alongside initiatives like CCS hubs. However, these efforts are relatively modest compared to its core fossil fuel business, indicating a cautious approach to renewables.

Puma Energy

Puma Energy, a mid- and downstream oil company, shows no clear evidence of investments in renewable energies based on the available data. Its operations appear centered on traditional oil and gas activities, such as fuel distribution and acquisitions in the downstream sector (e.g., purchasing ExxonMobil’s downstream businesses in Central America). Without mentions of renewable projects or energy transition initiatives, Puma Energy’s current strategy seems firmly rooted in fossil fuels.

How These Oil Companies Navigate the Challenge

These energy companies are tackling the diversification challenge by adopting a phased approach, gradually increasing their investments in renewables while relying on oil revenues as a financial backbone. They often focus on areas where they hold competitive advantages—for example, offshore wind for companies like Equinor with offshore oil experience, or hydrogen for those with gas expertise. However, the lower profitability of renewables compared to oil requires meticulous portfolio management to avoid financial strain. TotalEnergies and Repsol continue to invest significantly in renewables.

While some companies maintain some renewable investments, their primary focus has unmistakably returned to oil and gas. The shifts by Shell and BP are not isolated but reflect broader trends in the energy sector. Several external factors have contributed to this recalibration:

- Political Climate: The re-election of Donald Trump, a known climate skeptic and fossil fuel advocate, has bolstered the outlook for oil and gas investments. This political shift, combined with the war in Ukraine, has heightened global concerns about energy security, further justifying a focus on fossil fuels.

- Industry Trends: Other major players like ExxonMobil and Chevron have also reduced their renewable energy investments, prioritizing short-term gains from oil and gas amid high demand and prices.

- Economic Pressures: The lower profitability of renewables, coupled with increased competition in the sector, has made fossil fuels a more attractive option for delivering shareholder value.

II.Oil’s Comeback vs. Climate Compliance: Trump’s Deregulation Clashes with Europe’s Green Push

-

Trump’s January 2025 Policies Bolstering Oil Companies

In January 2025, President Donald Trump signed executive orders aimed at strengthening the oil and gas industry. These policies focus on three key initiatives: streamlining permitting processes, increasing access to federal lands for drilling, and lifting restrictions on liquefied natural gas (LNG) exports. Together, these measures are designed to reduce operational costs and expand market opportunities for oil companies.

Key Policy Changes

- Streamlined Permitting: The orders expedite the approval process for oil and gas projects by directing federal agencies to reduce bureaucratic delays. This applies to drilling on federal lands and offshore areas, allowing companies to launch projects faster.

- Access to Federal Lands: Previously restricted areas, such as parts of Alaska (e.g., the Arctic National Wildlife Refuge), are now open for exploration and extraction, providing access to untapped oil and gas reserves.

- Lifted LNG Export Restrictions: By removing barriers to LNG exports, companies can sell more natural gas to international markets, particularly in Europe and Asia, where demand is rising.

Impact on Oil Companies

These policies benefit oil companies by:

- Lowering Costs: Faster permitting reduces delays and administrative expenses, freeing up capital for production and development.

- Expanding Production: Access to federal lands increases the potential for discovering and extracting new reserves, boosting overall output.

- Enhancing Market Reach: Lifting LNG export restrictions opens up lucrative global markets, increasing revenue potential.

Examples of Affected Oil Companies

- ExxonMobil: A leading U.S. oil producer, ExxonMobil can leverage streamlined permitting to accelerate its shale oil projects, particularly in the Permian Basin. The company’s significant investments in this region position it to quickly capitalize on reduced regulatory hurdles.

- Chevron: With a strong presence in the U.S., Chevron could expand exploration on newly accessible federal lands, such as in Alaska. Its operational expertise in challenging environments makes it a prime beneficiary of these policies.

- ConocoPhillips: Operating extensively in Alaska, ConocoPhillips stands to gain from both faster permitting and access to federal lands. The company has long supported expanded drilling in the region and could see significant production increases.

However, the hesitancy among companies like ExxonMobil, Chevron, ConocoPhillips, BP, Occidental, Cheniere, and Shell stems from a mix of economic, operational, and strategic considerations. The memory of past price crashes, the need to maintain financial discipline, and the long-term risks of the energy transition outweigh the immediate benefits of deregulation for many firms. Additionally, operational challenges and global market dynamics further temper enthusiasm for rapid expansion.

This caution reflects a broader industry trend: oil producers are prioritizing resilience and flexibility over short-term opportunism. While Trump’s policies may boost production incrementally, the era of unchecked drilling has given way to a more calculated approach, with companies balancing immediate gains against future uncertainties.

[4] Most talked-about and shared challenges in energy transition about 18 Multi-Energy and Oil companies between Dec 2024 – Mar 2025. Media and social media. Source: Energy Industry Media Analysis 2025

-

Inconsistent Climate-Related Disclosure Requirements and the next European Directive

Oil companies face growing challenges due to inconsistent climate-related disclosure requirements worldwide, compounded by the lack of global standardization. This issue is particularly pressing with the European Corporate Sustainability Due Diligence (CSDD) directive, set to take effect in 2026, which will impose stricter environmental reporting obligations.

Key Challenges

- Inconsistent Disclosure Standards: Without a unified global framework, oil companies must comply with varying climate disclosure rules across regions. This patchwork of regulations increases the complexity and cost of reporting environmental impacts.

- European CSDD Directive (2026): This upcoming regulation will require companies operating in Europe to provide detailed disclosures on their environmental footprint, including carbon emissions and sustainability practices. It aims to hold firms accountable for their climate impact, necessitating robust reporting systems.

Impact on Oil Companies

- Rising Compliance Costs: Meeting diverse disclosure requirements, especially the stringent European directive, demands significant investment in data tracking, reporting technologies, and personnel.

- Operational Adjustments: Companies may need to modify practices—such as reducing emissions or adopting cleaner technologies—to align with regulations, potentially conflicting with production-focused strategies.

Examples of oil companies concerned

- BP: With substantial operations in Europe, BP will need to enhance its reporting to comply with the CSDD directive. While the company has pursued sustainability goals, the new rules may require further investment in emissions tracking and reduction efforts.

- Shell: As another major player in Europe, Shell faces similar pressures. Its commitment to lowering its carbon footprint may need to accelerate, with the directive demanding more transparent and comprehensive climate disclosures.

- TotalEnergies: Based in France, TotalEnergies will be directly impacted by the European directive. Although it has diversified into renewables, the company must still upgrade its reporting systems to meet the CSDD’s rigorous standards.

III. Oil giants Invest in the Green Market: Navigating the minefield of renewable energies

Oil companies venturing into the renewable energy market face a complex array of challenges that extend far beyond simply adapting to a new industry. These obstacles arise from fundamental differences in business models, market dynamics, competitive pressures, and the evolving regulatory landscape. Below, I’ll outline the key challenges, including the three trends you mentioned—competition from established players, the need for geographic diversification, and the pivot toward low-carbon molecule technologies—while also exploring additional hurdles that make this transition particularly difficult.

1. Competition from Established Utilities and Specialized Firms: Duke Energy, NextEra Energy, Enel, E.ON

Oil companies entering the renewable energy market face stiff competition from established utilities and specialized renewable energy firms that have decades of experience, entrenched infrastructure, and strong customer relationships. The main established utilities in renewable energies—Iberdrola, NextEra Energy, Enel, E.ON, and Duke Energy—dominate due to their scale, grid infrastructure, and global operations. Specialized firms like Ørsted, Vestas, Canadian Solar, Siemens Games often leading in innovation and efficiency.

- Utilities’ Dominance: Utilities have a significant advantage due to their expertise in managing grid infrastructure, energy distribution, and customer bases, particularly in regulated markets where they often hold monopolies. This entrenched position makes it difficult for oil companies to penetrate the market without building new capabilities or forming strategic partnerships.

- Specialized Firms’ Expertise: Companies like Vestas (wind turbines) and First Solar (solar panels) have focused on specific renewable technologies, achieving cost efficiencies and technological leadership. Unlike oil companies, which are used to large, centralized projects like drilling platforms, these firms excel in the distributed, modular nature of renewable projects—posing an operational mismatch for newcomers.

- Shift in Customer Relationships: In oil and gas, companies typically serve large industrial clients. Renewables, however, often involve direct engagement with end consumers, such as homeowners installing rooftop solar or small businesses adopting wind energy. Oil companies lack the marketing and service infrastructure to effectively manage this diverse, consumer-facing customer base, requiring a significant shift in approach.

2. Geographic Diversification to Leverage Regional Variations

The renewable energy market demands geographic diversification to optimize returns and manage risks, a stark contrast to the concentrated operations of oil companies in oil-rich regions.

- Regional Price and Resource Variations: Renewable energy profitability depends heavily on local conditions—solar projects thrive in sunny regions like the southwestern U.S., while wind farms perform best in windy areas like northern Europe. Media reports highlight that energy prices and government incentives vary widely, requiring oil companies to expand their geographic footprint to capture these opportunities.

- Portfolio Diversification Reduces Risk: Diversifying across regions and technologies (e.g., solar, wind, hydro) can eliminate 50-80% of investment risk by balancing exposure to volatile markets and regulations. However, oil companies, accustomed to managing a few large assets, often lack the expertise to assess and oversee a broad portfolio of smaller renewable projects.

- Logistical and Financial Challenges: Expanding into new regions involves significant costs—site development, permitting, and grid connections—all while maintaining capital-intensive fossil fuel operations. This dual burden stretches resources and requires careful financial planning.

3. Pivot Toward Low-Carbon Molecule Technologies

Specialists note that oil companies are increasingly focusing on low-carbon molecule technologies—like hydrogen, carbon capture and storage (CCS), and biofuels—rather than traditional solar and wind, driven by competitive pressures and profitability concerns.

- Crowded Conventional Markets: Solar and wind markets are highly competitive, with lower barriers to entry and slim margins (typically 5-10% returns compared to 15-20% in oil and gas). This drives oil companies to seek niches where they can maintain higher profitability and avoid direct competition with established players.

- Leveraging Existing Strengths: Low-carbon technologies align with oil companies’ core competencies in chemistry and industrial processes:

- Hydrogen: Expertise in gas processing can be adapted to produce “blue hydrogen” (from natural gas with CCS) or distribute green hydrogen.

- CCS: Knowledge of subsurface geology from oil exploration aids in identifying CO2 storage sites.

- Biofuels: Refining skills can be repurposed to develop advanced biofuels.

- Profitability Focus: The lower returns in traditional renewables, combined with the need to sustain legacy operations, push oil companies toward these emerging technologies, which promise better integration with existing assets and potentially higher margins.

4. Additional Challenges when entering the renewable energy market:

Oil companies could face a host of other obstacles:

- Cultural and Operational Shifts: Oil companies are built for large, centralized projects with high upfront costs and long payback periods. Renewables require smaller, more frequent investments with quicker returns, demanding a cultural shift toward agility and decentralized management.

- Technological Gaps: Solar and wind rely on electrical engineering and grid integration—areas where oil companies have limited expertise. Their strengths lie in mechanical and chemical engineering, necessitating investment in R&D or partnerships to bridge this divide.

- Regulatory Uncertainty: Renewable energy is shaped by a patchwork of government policies, subsidies, and carbon pricing, which can shift rapidly. Oil companies must navigate this complexity, unlike the more predictable regulatory frameworks of oil and gas.

- Integration and Intermittency: Renewable sources like wind and solar are intermittent, requiring grid upgrades and energy storage solutions (e.g., batteries). Oil companies, used to the reliability of fossil fuels, must invest in these technologies to ensure a stable supply—an added cost and complexity.

- Workforce Transition: Employees skilled in fossil fuel extraction need retraining for renewable projects, or new talent must be hired. This process is costly and may face resistance from workers rooted in the oil and gas industry.

- Public and Investor Pressure: While there’s demand for oil companies to transition, skepticism about their commitment (e.g., accusations of “greenwashing”) can harm their reputation and investor relations if renewable efforts falter.

- Financing Hurdles: Green finance is growing, but oil companies may struggle to secure favorable terms without a proven track record in renewables, facing higher costs or stricter criteria than established players.

- Stranded Asset Risk: As the world shifts to renewables, oil companies must balance divestment from fossil fuels (to avoid stranded assets) with cautious investment in renewables, requiring a delicate strategic approach.

IV. Drilling into the Future: How AI, Drones, and Automation Are Rewiring Big Oil

Technological innovations, including artificial intelligence (AI), automation, drones, and big data, are transforming the oil and gas industry by enhancing efficiency, reducing costs, improving safety, and addressing environmental pressures. These advancements are critical as oil companies navigate challenges like market volatility, the energy transition, and regulatory changes, while also competing with renewable energy sectors.

1. Artificial Intelligence (AI)

- Advanced Exploration and Carbon Management: AI will enhance 4D seismic imaging for ultra-deep reservoirs and support carbon capture and storage (CCS) by identifying optimal storage sites. This aligns with oil companies’ pivot to low-carbon molecule technologies (e.g., hydrogen, CCS) to stay relevant in a decarbonizing world.

- Future Potential: AI could reduce exploration costs by 30-40% and enable CCS projects to scale, helping companies like Shell and TotalEnergies meet net-zero goals.

- Autonomous Operations: AI will drive fully autonomous drilling and production systems, minimizing human intervention and enabling operations in extreme environments like the Arctic or deep offshore.

- Future Potential: Companies like BP could operate remote fields with 50% fewer personnel, slashing costs and improving safety.

- Integration with Renewables: AI will optimize hybrid energy systems, managing oil and renewable assets (e.g., solar farms powering oil fields) to reduce emissions and costs.

- Future Potential: ExxonMobil could use AI to integrate solar power into its Permian operations, cutting operational emissions by 20-30%.

2. Automation

- End-to-End Automation: Future automation will encompass entire value chains, from exploration to refining, with interconnected systems optimizing performance in real time.

- Future Potential: Chevron could automate its global operations, reducing costs by 20-30% and enabling faster project scaling.

- Robotics for Maintenance: Advanced robots will perform complex maintenance tasks in hazardous environments, such as deep-sea platforms or high-pressure refineries.

- Future Potential: Equinor’s offshore fields could see maintenance costs drop by 40%, with robots handling subsea repairs.

- Green Automation: Automation will support low-carbon technologies, such as automated hydrogen production or CCS facilities, aligning with the industry’s shift to sustainable solutions.

- Future Potential: Eni could automate its CCS projects, reducing operational costs and accelerating decarbonization.

3. Drones

- Autonomous Drone Fleets: Future drones will operate in coordinated fleets, using AI to perform continuous monitoring, maintenance, and emergency response tasks across vast oil fields or pipelines.

- Future Potential: Saudi Aramco could deploy drone fleets to monitor its 25,000 km pipeline network, cutting inspection times by 60%.

- Environmental and Regulatory Compliance: Drones will integrate with IoT and big data to provide real-time emissions data, helping companies comply with stringent regulations like the European Corporate Sustainability Due Diligence directive (2026).

- Future Potential: BP could use drones to ensure compliance across its European operations, reducing regulatory fines.

- Hybrid Energy Monitoring: Drones will monitor hybrid energy projects (e.g., solar panels powering oil rigs), supporting oil companies’ diversification into renewables.

- Future Potential: TotalEnergies could use drones to optimize its solar-wind hybrid projects, improving energy efficiency by 15%.

4. Big Data

- Predictive Market Insights: Big data will forecast global energy demand, oil prices, and renewable adoption trends, enabling oil companies to balance investments between fossil fuels and renewables.

- Future Potential: Occidental Petroleum could use predictive analytics to allocate capital, reducing investment risk by 20-30%.

- Digital Twins: Big data will power digital twins—virtual models of oil fields, rigs, or refineries—allowing real-time simulation and optimization of operations.

- Future Potential: ConocoPhillips could deploy digital twins for its Alaskan fields, boosting production efficiency by 15-20%.

- Sustainability Integration: Big data will track carbon footprints across operations, supporting low-carbon strategies like hydrogen production or CCS, and aiding compliance with global climate standards.

- Future Potential: Shell could use big data to reduce its carbon intensity by 25%, aligning with net-zero targets.

Drilling on the Edge: Adapt or Ignite a New Era, or the uncertain future of the oil industry

An analysis of the oil industry’s media landscape in 2024-2025 reveals a sector undergoing profound change, torn between contradictory forces. On the one hand, there is growing pressure for a transition to a more sustainable energy model, driven by climate concerns and new regulations, particularly at European level. On the other, a return to fossil fuels encouraged by US deregulation policies and the economic realities of a market where oil remains more profitable than alternative energies.

Against this backdrop, several scenarios are emerging for the next decade:

- The emergence of a hybrid model in which oil companies gradually become ‘integrated energy companies’, simultaneously managing portfolios of fossil fuels and renewable energies.

- Increased polarisation of the sector between traditional players focused on optimising fossil resources and new entrants specialising in alternative energies

- An acceleration in technological innovations to reduce the carbon footprint of oil operations, while developing transitional energy solutions such as hydrogen and carbon capture.

One thing remains certain: the reputation of companies in the oil sector will continue to be closely linked to their ability to demonstrate a credible commitment to the energy transition, going beyond rhetoric and promises. Consumers, investors and regulators will continue to exert increasing pressure for a substantial transformation of the global energy model, presenting the oil industry with an existential challenge unprecedented in its history.

Download our complete Energy Industry Media Analysis 2025 for the full insights.