Introduction: A Market on the Move

The sportswear market is one of the most dynamic sectors for brand communicators. This competitive landscape requires constant monitoring of brand visibility, narrative positioning, and reputation management.

At Onclusive, we analyse millions of media and social conversations every day across established and emerging platforms. This scale gives us a uniquely data-driven perspective on how leading sportswear brands handle complex communication challenges, build visibility, and shape narratives in a highly competitive market.

For media and communications professionals, the sportswear market offers key lessons in reputation management and crisis response. Major narrative shifts include faster sustainability storytelling, the rise of athleisure brand identity, and challenger brands using social-first strategies to outpace established players.

According to McKinsey and the World Federation of the Sporting Goods Industry, the sportswear market is projected to grow around 6% annually between 2024 and 2029, down from 7% in previous years. This steady demand underscores the need for brands to differentiate through innovation and communications strategy.

Key Takeaways – Sportswear Market Trends

- Smart wearables are reshaping the sportswear market by merging technology with lifestyle and performance.

- Athleisure has become a core brand identity strategy, blending fashion and function beyond its origins as a trend.

- ESG storytelling boosts visibility but carries risks of greenwashing without measurable proof.

- Challenger brands disrupt legacy players through agility, innovation, and community-first engagement.

- Future growth in the sportswear market will be driven by personalization and data-led communication strategies.

How Big is the Sportswear Market?

The global sportswear market shows strong growth that directly impacts brand communication strategies. Allied Market Research projects the global sports apparel market will reach $248.1 billion by 2026. This represents 5.1% compound annual growth from 2019 to 2026.

Nike leads the market with $51 billion in sales by 2023. This shows how comprehensive brand communication approaches build market positioning. Our media monitoring analysis reveals that Nike and Adidas dominate social and mainstream media. Yet smaller brands like New Balance and Lululemon have carved out significant media niches through targeted communication strategies.

Media and Narrative Trends Shaping the Sector

Our complete analysis identifies three key narrative trends changing sportswear market communications:

Smart Wearables and Innovation-Driven Messaging:

Smart wearables in the sportswear market are technology-enabled garments and accessories that track health, fitness and lifestyle data. These innovations turn clothing and devices into performance tools, helping brands position themselves as leaders in both technology and activewear.

- Technology integration has become central to brand storytelling.

- Partnerships between sportswear companies and tech firms generate significant media coverage.

- These collaborations help brands position themselves within innovation narratives while reaching new audiences.

Athleisure as Brand Identity Evolution

Athleisure in the sportswear market refers to clothing designed for both athletic performance and everyday wear, blending comfort, functionality and lifestyle fashion. This trend has redefined consumer expectations, transforming sportswear from purely functional apparel into a cultural and fashion statement.

- Athleisure has moved beyond fashion trends to become a core brand positioning strategy.

- Communications teams use this shift to blur category boundaries.

- This enables lifestyle brand expansion while maintaining athletic credibility.

ESG and Sustainability Storytelling

ESG in the sportswear market means integrating environmental, social and governance principles into product design, supply chains and brand storytelling. Consumers now expect brands to demonstrate authentic commitments to sustainability, from materials and production methods to marketing narratives.

Our social listening analysis shows that credible sustainability storytelling boosts media visibility. However, brands face increased scrutiny over greenwashing accusations. Adidas’s focus on eco-friendly product lines shows how sustainability initiatives can drive media coverage and sales when authentically integrated.

This pressure is driving the industry toward more structured approaches. For example, the Global Fashion Agenda and Deloitte recently launched a Fashion Impact Toolkit to help brands measure and report ESG performance across the textile value chain. For communicators, the lesson is clear: sustainability stories resonate most when they are backed by measurable progress and transparent reporting.

What’s Driving Market and Media Growth?

Health and Fitness as Reputation Drivers

The increased focus on health awareness creates ongoing content opportunities for brand communicators. Companies that align their messaging with wellness narratives benefit from enhanced media coverage and improved brand perception.

Social and Earned Media Influence on Brand Buzz

Our media analysis shows that strategic social media engagement drives significant brand visibility. Nike’s digital transformation strategy includes direct-to-consumer channels and the Nike+ membership programme. This digital-first approach generates valuable consumer data while personalising marketing communications.

Cultural Inclusion and Representation

Brands increasingly use inclusive messaging and diverse representation to reach new audiences while generating positive media coverage. This shows how authentic brand storytelling can drive market growth and enhance corporate reputation.

Challenger Brands: Visibility Beyond Market Share

Challenger brands in the sportswear market are smaller, often niche-focused companies that disrupt industry leaders with agility, innovation and community-driven storytelling. They may not have the scale of legacy giants, but their ability to connect authentically with consumers allows them to punch above their weight in visibility and influence.

This contrast becomes clearer when you compare the strengths, challenges and communication approaches of challenger vs legacy brands:

| Brand Type | Strengths | Challenges | Communications Approach |

| Challenger Brands | Agility, innovation, niche positioning, strong community engagement | Limited resources, smaller scale, struggle to compete on distribution | Social-first strategies, influencer partnerships, bold collaborations, disruptive storytelling |

| Legacy Brands | Scale, global recognition, established trust, resources for R&D and sponsorships | Seen as slower-moving, risk of being perceived as corporate or outdated | Mass-market campaigns, sponsorship of global events, emphasis on sustainability leadership |

Comparison table showing key differences between challenger sportswear brands and legacy giants, highlighting their respective strengths, challenges, and communication strategies.

Our Share of Voice analysis reveals how emerging players disrupt traditional media dominance in the sportswear market. While Nike and Adidas maintain highest visibility metrics, challenger brands use sophisticated communication strategies. They generate disproportionate media attention relative to their market size.

New Balance exemplifies this phenomenon. It outperforms competitors like Lululemon in media presence through strategic positioning as a premium alternative to mass-market brands. The company’s communication strategy emphasises technical innovation, quality craftsmanship, and Made-in-USA production messaging.

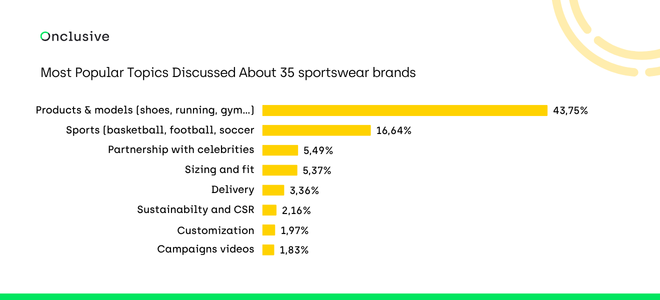

Our social listening analysis reveals specific communication patterns driving engagement. Consumer conversations about sportswear brands center around products, especially footwear. Nike dominates these discussions, followed by Adidas, Asics, and New Balance

Social media buzz focuses on:

- Collaborations between sportswear brands and fashion designers

- Limited edition releases and exclusive collections

- Innovative materials and technologies in everyday wear

- Customization options for consumer personalisation

Strategic partnerships generate measurable engagement across platforms:

- Celebrity athlete endorsements drive massive social media engagement

- Collaborations with musicians and artists attract younger demographics

- Sponsorships of major sporting events create global visibility spikes

- Partnerships with tech companies for smart wearables generate buzz in tech and fitness communities

Challenges Facing Brand Communicators in Sportswear

Greenwashing Accusations and Brand Scrutiny

Sustainability communications present both opportunities and significant risks for sportswear market brands. Our media monitoring analysis reveals increased scrutiny over environmental claims. Communications teams must ensure authenticity in all sustainability messaging to avoid damaging greenwashing accusations.

Supply Chain Issues and PR Fallout

Global supply chain disruptions create ongoing communication challenges for sportswear brands. Proactive crisis communication strategies become essential as supply chain transparency increasingly influences brand reputation and media coverage.

Navigating Audience Fatigue and Authenticity Gaps

Adidas’s challenges following the termination of its Yeezy partnership show how high-profile celebrity endorsements carry significant reputational risks. Communications teams must develop contingency strategies for managing partnership dissolution while maintaining brand positioning integrity.

Future Outlook: What Comms Leaders Should Watch

The future of the sportswear market is defined by growth, personalization and data-driven communication strategies that put consumers at the centre. Brands that anticipate these shifts will be better positioned to maintain relevance, trust and competitive advantage in an increasingly crowded landscape.

Projected Growth Impact on Brand Messaging The projected 5.1% compound annual growth rate creates intensified competition for consumer attention. This requires more sophisticated and differentiated communication strategies. Brand messaging must evolve beyond traditional product-focused communications toward lifestyle and identity-driven narratives.

Customisation and Personalisation Communications Although customisation represents only 1.97% of overall consumer conversations about the sportswear market, this emerging trend shows significant growth potential for brand communicators. Discussions about customisation are rising.

Seven key factors drive this trend:

- Consumer desire for personal expression, particularly among Gen Z and Alpha generations

- Technological advancements including AI, 3D printing, and virtual reality enabling brands like Nike By You, Adidas, and Vans to offer customisation services at scale

- Sustainability concerns encouraging slower fashion consumption

- Enhanced consumer engagement through interactive design processes

- Growth of direct-to-consumer models enabling faster response to individual preferences

- Limited edition and exclusive drops culture fueling “made-to-order” models

- Data-driven personalisation using consumer data and AI to predict individual customisation preferences

Data-Driven Communication Strategies Brands increasingly leverage consumer data and AI to develop targeted communication approaches. This evolution requires communications teams to develop data literacy capabilities while maintaining authentic brand voice across personalised touchpoints.

Conclusion: Comms Strategy Will Define Market Leadership

The sportswear market’s evolution shows how strategic communication approaches directly influence market positioning and competitive advantage. Our comprehensive media monitoring and social listening analysis reveals that successful brands integrate several critical elements:

- Robust digital presence capabilities

- Strategic partnership activations that enhance credibility

- Continuous innovation in marketing communications

- Authentic sustainability messaging

- Agile response capabilities

Key takeaways for communications leaders include agility in narrative development, credibility in ESG communications, and clarity in brand positioning. These differentiate companies within increasingly competitive media landscapes.

Understanding these dynamics through comprehensive media monitoring and social listening insights proves crucial for communications professionals operating within the sportswear market. The brands that will define future market leadership recognise communications strategy as fundamental to business success. They integrate media intelligence, authentic storytelling, and strategic partnership activation into comprehensive reputation management approaches.

FAQ: The Sportswear Market

- What are the biggest trends in the sportswear market?

The sportswear market is shaped by smart wearables, athleisure, ESG storytelling, challenger brand disruption, and personalization. - Why is sustainability important in the sportswear market?

Consumers expect brands to back sustainability claims with measurable progress, making ESG central to reputation and growth. - How are challenger brands disrupting the sportswear market?

Challenger brands use agility, niche positioning, and social-first engagement to capture attention and outpace legacy players. - What role do smart wearables play in the sportswear market?

Smart wearables connect technology and performance, giving consumers data-driven insights and expanding brand storytelling opportunities.