In the world of fast fashion, two brands—Shein and Temu—are making significant waves. These brands have not only challenged typical fast fashion retailers but have also revolutionised how consumers interact with fashion brands through technology, aggressive marketing and ad spending, and innovative customer engagement strategies. We carried out a social listening analysis of eight, global fast fashion brands to understand the true impact they’re having on the market and consumer behavior. The eight brands we examined are: Temu, Shein, H&M, Zara, Mango, Zalora, Asos, and Zalando.

Access the full Fashion Industry report here.

The Rise of Temu: A New Powerhouse in the Fast Fashion Industry

Temu, a relatively new entrant in the fast fashion industry, has quickly become a dominant force. Established in 2022, Temu’s rapidly gained traction, especially in the U.S., where it’s outpaced even Shein in terms of sales.

A significant factor in Temu’s success is its innovative approach to consumer engagement. Temu leverages “shopatainment,” a blend of shopping and entertainment, to attract and retain customers. This approach involves interactive games within the app that offer discount coupons and gifts, making the shopping experience more engaging and fun.

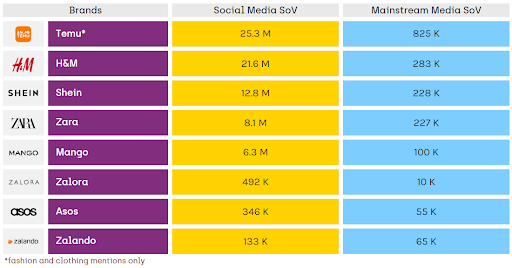

Temu’s impact is evident. In our social listening analysis of fast fashion brands, we discovered that the brand received 25.3 million social media mentions over the last 12 months. Temu outstrips its competitors, including H&M (21.6 million) and Shein (12.8 million). This dominance extends beyond social media, as Temu also leads in mainstream media coverage with 825,000 mentions, showcasing the brand’s ability to capture both consumer attention and media interest.

Shein: A Global Fast Fashion Industry Giant

Shein, another powerhouse in the fast fashion industry, has been a significant player for several years. While Temu may have overtaken Shein in U.S. sales, Shein still holds a stronger position globally, operating in more countries and achieving nearly double Temu’s global sales. Shein’s success can be attributed to its extensive product range, competitive pricing, and a robust social media strategy that resonates with younger audiences.

Despite facing stiff competition from Temu, Shein continues to innovate. The brand’s acquisition of the British brand Missguided is a strategic move to strengthen its position in the fashion market. Moreover, Shein’s focus on expanding its fashion brand, as opposed to Temu’s broader product range, highlights its commitment to remaining a key player in the global fast fashion industry.

The Role of Social Listening in the Fast Fashion Industry

The data underscores the importance of social monitoring in the fast fashion industry. It’s become a crucial tool for brands to understand and engage with their audiences in order to build a loyal customer base in a highly competitive market.

Temu’s social media strategy is particularly noteworthy. The brand’s use of gamification and interactive content has resonated with consumers, driving high levels of engagement and brand loyalty. On the other hand, Shein’s social media approach focuses on influencer partnerships and user-generated content, creating a community-driven marketing strategy that has been highly effective.

The Role of Corporate Social Responsibility (CSR) in the fast fashion industry

As the fast fashion industry faces increasing scrutiny over its environmental and social impact, brands like H&M are placing a greater emphasis on Corporate Social Responsibility (CSR). H&M, which ranks second in social media mentions with 21.6 million, has focused on CSR initiatives such as using organic cotton and offering clothing donation and recycling programs. These efforts not only enhance the brand’s reputation but also appeal to the growing segment of consumers who prioritise sustainability in their purchasing decisions.

In contrast, Shein and Temu have been widely criticised for their lack of transparency and sustainability efforts. As these brands continue to grow, they will likely face increasing pressure to address these concerns and implement more sustainable practices.

New Competition for Fast Fashion Industry Giants is incoming

Amazon is preparing to challenge Shein and Temu with the launch of its own discount store, which is expected to launch later this year. This new section on Amazon’s website will feature low-cost clothing, home goods, and other consumer items shipped directly from China, mimicking the model that has fueled the rapid rise of Shein and Temu.

This move signals Amazon’s most aggressive strategy yet to capture market share from the likes of Shein and Temu. With this new discount store, Amazon could significantly disrupt the fast fashion industry, forcing Shein and Temu to closely monitor these developments to maintain their competitive edge. Carrying out consistent, real-time social listening analysis will be a vital tool that these brands will need to employ to keep one-step-ahead of Amazon’s plans for market domination.

Conclusion

Shein and Temu are reshaping the fast fashion Industry through innovative consumer engagement strategies, aggressive marketing, and a strong presence on social media. With effective use of social listening analysis, these brands have been able to stay ahead of trends and maintain a competitive edge.

While Temu has quickly risen to prominence with its shopatainment approach, Shein remains a global fashion giant with a robust international presence. As these brands continue to evolve, they will undoubtedly play a significant role in shaping the future of fast fashion, setting new standards for how brands connect with consumers.

However, as the industry moves forward, the importance of sustainability and ethical practices cannot be overlooked. Brands that successfully balance innovation with responsibility will likely emerge as the leaders in the next phase of fashion’s evolution.

Want to see how Shein and Temu compare to other fast fashion brands across social and mainstream media? Our report uncovers the data, along with broader industry trends and topics driving consumer conversations. Plus, learn about the rising impact of second-hand platforms like Vinted and Depop. Download the report now.

Learn more about our media monitoring tools and how they can provide critical insights for your strategies. Contact us for a demo.